3-19 #Quarantine : Intel has announced the first phase of its plans of investment in Europe; Google has reportedly acquired Raxium; Samsung SDI is reviewing building a separate battery plant in the US; etc.

Intel has announced the first phase of its plans to invest as much as EUR80B (USD88B) in the European Union over the next decade. Intel announced that it would invest billions of euros into its research and development (R&D) facilities and manufacturing and chip factories. The announcement includes plans to invest an initial EUR17B (USD18.7B) into a leading-edge semiconductor fab mega-site in Germany, to create a new R&D and design hub in France, and to invest in R&D, manufacturing and foundry services in Ireland, Italy, Poland and Spain”. Intel previously announced plans to invest more than USD20B in the largest semiconductor site in the world in Ohio. (CN Beta, Intel, Pocket Now)

Chip design firm SiFive has raised USD175M at a USD2.5B as RISC-V emerges as an alternative processor architecture. The funding comes at a time when RISC-V is showing greater momentum as an alternative processor architecture to those run by Intel / AMD and Arm. SiFive is substantially accelerating the development of the company’s RISC-V products as it tries to broaden the reach of processors into multiple markets. SiFive is beefing up its future roadmap, and ecosystem to fulfill the potential that RISC-V has for SiFive’s customers. (VentureBeat, Forbes, SiFive)

The output value of the world’s top 10 foundries in 4Q21 reached USD29.55B, or 8.3% growth QoQ, according to TrendForce’s research. This is due to the interaction of two major factors. One is limited growth in overall production capacity. At present, the shortage of certain components for TVs and laptops has eased but there are other peripheral materials derived from mature process such as PMIC, Wi-Fi, and MCU that are still in short supply, precipitating continued fully loaded foundry capacity. Second is rising average selling price (ASP). In the fourth quarter, more expensive wafers were produced in succession led by TSMC and foundries continued to adjust their product mix to increase ASP. In terms of changes in this quarter’s top 10 ranking, Nexchip overtook incumbent DB Hitek to clinch 10th place. (TrendForce, TrendForce, Laoyaoba)

According to Ross Young, CEO of Display Supply Chain Consultants (DSCC), Samsung Display is preparing to ship 8.7M foldable panels for the Galaxy Z Flip 4 to Samsung Electronics. That would mean a 70% jump in the initial order from 5.1M in 2021. The shipments will reportedly begin in Apr 2022. As Young notes, the initial shipment for the Galaxy Z Flip 3 foldable screens in 2021 also began around the same time. At this rate, the Galaxy Z Flip 4 could arrive in Aug 2022, or latest by Sept 2022. (Android Headlines, Twitter)

For U.S. consumers still using older devices, Samsung offers cheap screen repairs for Galaxy S / Note series smartphones. Samsung Galaxy S or Note series smartphone owners in the US can enjoy a repair and replacement service for as little as USD100 if the display is cracked (or otherwise damaged). (CN Beta, Samsung, Android Authority)

Google has reportedly acquired Raxium, a 5-year-old startup that develops tiny light-emitting diodes for displays used in augmented and mixed reality devices. Raxium’s work revolves around Micro LEDs, which can make the kind of tiny displays AR devices need. In 2014, Apple acquired a MicroLED display manufacturer called LuxVue, and in 2020, Meta reached a deal to purchase all MicroLED displays produced by Plessey in the UK. In early 2022, Snap reportedly acquired Compound Photonics, which focuses on the augmented reality field and mainly develops MicroLED display technology.(CN Beta, The Information, Ars Technica, 9to5Google)

Zhou Hua, chief analyst at CINNO Research, has indicated that that due to the Spring Festival holiday and weak smartphone demand in the traditional off-season, the price of a-Si / LTPS smartphone panels in Feb 2022 drops by USD0.1 compared to Jan 2022; AMOLED panel prices will be affected by chip prices. Continued rise affects the continuous high and sideways, and some of the rigid AMOLED panel prices are raised. CINNO Research predicts that AMOLED panel prices will continue to remain high in Mar and Apr 2022; a-Si product prices will continue to drop slightly by USD0.1 in Mar 2022, and LTPS prices will remain stable. (CN Beta, Sohu)

Apple may finally be including OLED displays in upcoming MacBook Pro laptops. According to TF Securities analyst Ming-Chi Kuo, the switch in display technology would hinge on the iPad’s adoption of OLED. He suggests that the MacBook would use OLED in 2025 at the earliest if Apple could successfully release 12.9” & 11” OLED iPads in 2024. (CN Beta, 9to5Mac, MacRumors, WCCFtech, TechRadar, Twitter)

LG Display (LGD) reportedly has been evaluating the deposition process for Gen 8.5 (2200x2500mm) OLED panels since Dec 2021. The evaluation is being done at its supplier Sunic System’s facility at Paju. The facility houses Sunic System’s Gen 8.5 half-cut and vertical deposition equipment. Other suppliers to LGD have also provided their equipment and materials necessary for the evaluation to the Paju facility. YAS has supplied its deposition source; Hansong Neotech has provided its tensioner that is used to fix the mask in place; Avaco its logistics equipment and LG Innotek have provided the mask needed for the deposition process. LGD is aiming to supply Gen 8.5 OLED panels, which will be used for IT applications, to Apple for their first OLED MacBook, which is expected to launch around 2025. LGD is planning to use its Gen 6 OLED lines for the two OLED sporting iPads (12.9” and 11”) that are expected to debut earlier than the OLED MacBook. (MacRumors, The Elec)

Google has been rumored to be working on a foldable Pixel called Google Pixel Notepad. Google is trying its best to keep the Pixel Notepad affordable. The company has reportedly set a target price of USD1,399, but it remains to be seen if can hit that price. Google is planning to start the mass production of Pixel fold in 3Q22. (CN Beta, Notebook Check, Phone Arena, Pocket Now, Twitter)

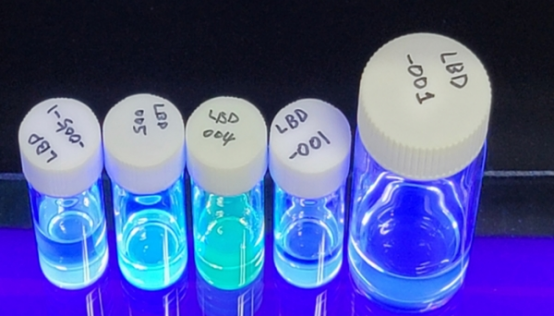

OLED material startup Lordin it has filed a patent related to blue OLED technology with high light emission efficiency. The ompany CEO Oh Hyoung-yun has said the technology offers high-efficiency and a longer life span for the blue OLED materials used in OLED panels. Lordin is aiming to commercialize the technology on smartphones and TVs in 2024. Oh has claimed that the patent offers over 90% internal light emission efficiency in the blue OLED material. This is triple that of the 25% in efficiency offered in current OLED panels used in smartphones and TVs. (Laoyaoba, The Elec)

In 2022, some manufacturers will reportedly reduce the price of mobile phone camera CIS several times. Currently, the cost down of phone camera CIS has penetrated into the camera chip products of 2MP, 5MP and 8MP. Among them, the unit price of 2MP and 5MP mobile phone camera CIS fell by about 20% and more than 30% year-on-year, respectively. (CN Beta, Laoyaoba)

According to Electrend, Redmi K50 series camera module suppliers are O-Film, Sunny Optical, Samsung; lens suppliers are AAC, O-Film, Sunny Optical, Largan; camera chip suppliers are Sony, Samsung ; VCM suppliers are Hozel, Shicoh Motor, and Samsung. Different from the past, the Redmi K50 camera has started using Hozel’s OIS motor. This is also the first time that a China domestic OIS motor has supported a camera chip smaller than 1/1.7” on the mobile phone. (Sunrise Big Data)

IC Insights forecasts NAND flash memory capital spending to rise 8% this year to USD29.9B, surpassing the previous all-time high mark of USD27.8B spent in 2018. Flash memory capital spending soared in 2017 when the industry transitioned to 3D NAND and has topped USD20.0B every year since. In 2022, capital spending for flash memory is forecast to increase to USD29.9B as big suppliers and small maintain moderately aggressive spending levels another year. The USD29.9B in spending represents 16% of the USD190.4B in capital spending forecast for the total IC industry in 2022 and trails only the foundry segment, which is forecast to account for 41% of industry capex in 2022. (Laoyaoba, IC Insights)

Samsung SDI CEO Yunho Choi has indicated that the company is reviewing building a separate battery plant in the US besides the one it is planning to build through a joint venture with Stellantis. The ultimate aim is to become the top battery maker globally in 2030. In 2021, Samsung SDI spent KRW2T on its facilities. Its revenue in Europe has expanded thanks to the start of production of Gen 5 electric vehicle batteries there. Gen 5 batteries are made in Samsung SDI’s factory in Goed, Hungary, and went into production in 2021. (Laoyaoba, The Elec)

Samsung SDI has started the construction of the industry’s first pilot line for all-solid-state batteries. The company has announced that it broke ground for a pilot all-solid-state battery line on a 6,500-square-meter site on the premise of its research institute in Yeongtong-gu, Suwon of Gyeonggi Province. Samsung SDI is developing a solid state battery with sulfide-based electrolytes. Compared to polymer-oxide-based electrolytes, this electrolyte has strengths in production scale expansion and charging speed. Samsung SDI has secured a design and patents on sulfide electrolyte materials and has entered the technology verification stage. (Laoyaoba, Business Korea)

Samsung has announced that One UI 4.1, which first debuted alongside the Samsung Galaxy S22 series, will be available on a wide range of Galaxy devices, bringing the latest Galaxy innovations to more users. Starting with the Galaxy Z Fold3 and Galaxy Z Flip3, the software update will include the Galaxy S21 series, Galaxy A series and Tab S7 FE. The update will extend to even more Galaxy devices, including the S20 series, Z Fold,3 Z Flip, Note series,5 S10 series, A series and Tab S series.(Samsung, Engadget)

Foxconn has restarted the production from its manufacturing site in Shenzhen, China. The resumption of operations follows the lockdown in the region was lifted partially. It has currently restarted production and operations in a limited manner from its Shenzhen site. To reopen the facility, the company has met every government conditions, while also providing the staff a place to live and work, within a bubble of arrangements. In other words, the firm has set up a “closed loop management” system. A similar system was also adopted for the Winter Olympics that took place in Beijing. (Reuters, Gizmo China, UDN, WSJ)

Careen Yapp from Google Stadia’s Strategic Business development division unveiled the new “Immersive Stream for Games” offering.The offering, which is created in partnership with Google Cloud, will allow companies to take advantage of Stadia’s underlying platform technology and deliver games directly to players. With this offering, Google is branching out by opening up Stadia’s streaming technology for other companies to license. (CN Beta, WCCFtech, TechCrunch, 9to5Google)

According to Counterpoint Research, sales penetration of 5G-capable smartphones reached 51% globally in Jan 2022, surpassing the penetration of 4G smartphones for the first time. China, North America and Western Europe were the biggest drivers of this growth. China had the highest 5G penetration in the world at 84%. The 5G smartphone penetration for North America and Western Europe reached 73% and 76%, respectively. Apple dominates North America and Western Europe with a sales share of over 50% and 30%, respectively. (Counterpoint Research, CN Beta, Laoyaoba)

Samsung has announced that the newly announced smartphones Galaxy A73, A53 and A33 will receive 4 major Android updates and security patches for 5 years, similar to the Galaxy S22 and other, more expensive phones.(GizChina, Sam Mobile)

JP Morgan analyst Samik Chatterjee analyzes lead times (or estimated delivery dates) for Apple’s new iPhone SE across multiple regions. Lead times extended across all regions that JP Morgan tracks. Estimated delivery times stand at an average of about 8 days as of 18 Mar 2022. He has further added that lead times have extended over the last week, and while that is an encouraging sign for demand, they will wait for more data points to draw conclusions given the ongoing shifts in supply and logistics in the background. (CN Beta, Apple Insider)

Redmi 10C is launched in Malaysia – 6.71” 720×1600 HD+ v-notch, Qualcomm Snapdragon 680, rear dual 50MP-2MP depth + front 5MP, 4+64 / 4+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, MYR559 (USD133) / MYR629 (USD150).(GSM Arena, Twitter, Lowyat)

Redmi 10 (India) is launched in India – 6.7” 720×1600 HD+ v-notch, Qualcomm Snapdragon 680 4G, rear dual 50MP-2MP depth + front 5MP, 4+64 / 6+128GB, Android 11.0, rear fingerprint, 6000mAh 18W, INR10,999 (USD145) / INR12,999 (USD171).(India Times, GSM Arena)

Redmi K50 and K50 Pro are announced, featuring 6.67” 1440×3200 QHD+ HiD OLED 120Hz:

- K50 – MediaTek Dimensity 8100, rear tri 48MP OIS-8MP ultrawide-2MP macro + front 20MP, 8+128 / 12+256GB, Android 12.0, side fingerprint, 5500mAh 67W, CNY2,399 (USD378) / CNY2,799 (USD440).

- K50 Pro – MediaTek Dimensity 9000, rear tri 108MP OIS-8MP ultrawide-2MP macro + front 20MP, 8+128 / 8+256 / 12+256GB, Android 12.0, side fingerprint, 5000mAh 120W, CNY2,999 (USD472) / CNY3,299 (USD520) / CNY3,999 (USD630).

(Android Authority, GSM Arena)

Redmi K40S is announced – 6.67” 1080×2400 FHD+ HiD AMOLED 120Hz, Qualcomm Snapdragon 870 5G, rear tri 48MP OIS-8MP ultrawide-2MP macro + front 20MP, 6+128 / 8+128 / 8+256 / 12+256GB, Android 12.0, stereo speakers, side fingerprint, 4500mAh 67W, CNY1,799 (USD283) / CNY1,999 (USD314) / CNY2,199 (UISD346) / CNY2,399 (USD377).(GizChina, GSM Arena)

Samsung Galaxy A73, A53 and A33 are announced:

- A73 – 6.7” 1080×2400 FHD+ HiD Super AMOLED+ 120Hz, Qualcomm Snapdragon 778, rear quad 108MP OIS-12MP ultrawide-5MP macro-5MP depth + front 32MP, 6+128 / 8+128 / 8+256GB, Android 12.0, fingerprint on display, 5000mAh 25W, IP67 rated, price yet unknown.

- A53 – 6.5” 1080×2400 FHD+ HiD Super AMOLED 120Hz, Samsung Exynos 1280, rear quad 64MP OIS-12MP ultrawide-5MP macro-5MP depth + front 32MP, 6+128 / 8+256GB, Android 12.0, side fingerprint, 5000mAh 25W, EUR450 / EUR510.

- A33 – 6.4” 1080×2400 FHD+ HiD Super AMOLED 90Hz, Samsung Exynos 1280, rear quad 48MP OIS-8MP ultrawide-5MP macro-2MP depth + front 13MP, 6+18GB, Android 12.0, side fingerprint, 5000mAh 25W, EUR370.

(Android Central, GSM Arena, Samsung, The Verge, SlashGear, SamMobile)

Huawei P50E is announced –6.5” 1224×2700 FHD+ HiD OLED 90Hz, Qualcomm Snapdragon 778G 4G, rear tri 50MP OIS-12MP OIS periscope telephoto 5x optical zoom-13MP ultrawide + front 13MP, 8+128 / 8+256GB, HarmonyOS 2.0, fingerprint on display, 4100mAh 66W, CNY4,088 (USD644) / CNY4,488 (USD706). (GSM Arena, IT Home, Huawei)

Huawei nova 9 SE is launched – 6.78” 1080×2388 FHD+ HiD 90Hz, Qualcomm Snapdragon 680 4G, rear quad 108MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128 / 8+256GB, Android 11.0 (no GMS), side fingerprint, 4000mAh 66W, CNY2,199 (USD346) / CNY2,399 (USD378). (GSM Arena,Gizmo China, Huawei)

Google has announced the Play As You Download feature to all Android 12 users. Google has also announced that it will soon launch an alpha of Steam for Chrome OS, available on “select Chromebooks”. The Steam for Chrome OS is now available in an Alpha program.(GizChina, Liliputing, Google for Games)

Meta is now adding parental supervision tools to its Meta Quest VR headset. As Meta’s headset became more popular, the lack of parental controls became a more glaring issue. The U.K.’s Information Commissioner’s Office applied added pressure by suggesting that the headset could breach its online children’s safety code. Currently, Quest headsets allow users to set up an unlock pattern, like a passcode, to gain access to their device. In Apr 2022, Meta will extend this functionality to apply to specific apps. If a parent does not want their child playing a certain game on a shared headset, they can set a specific unlock code for that app.(TechCrunch, Meta)

Germany’s Mercedes-Benz Group has said that it has opened a research and development (R&D) center in Shanghai that will focus on mobility technology. The center, its second R&D facility in China, will work in tech fields such as connectivity, automated driving and big data. The establishment of a new Shanghai tech center follows a move in 2021 by the German premium carmaker to significantly upgrade its R&D capabilities in Beijing by opening a new R&D facility in China’s capital. (CN Beta, Reuters, Asia Nikkei, Euro News)

T-Mobile and BMW are partnering to debut the first 5G-connected cars available in the United States. BMW is introducing America’s first 5G connected cars, the 2022 BMW iX and i4, powered by T-Mobile’s new Magenta Drive for BMW as part of a long-term agreement to bring unlimited voice calling and unlimited 5G data to BMW vehicles. Adding a BMW to T-Mobile plan will tack on USD20 a month and will allow the car to get unlimited data and voice calls.(The Verge, T-Mobile, T-Mobile)

TF Securities analyst Ming-Chi Kuo reports that Apple’s project team behind pre-production of the Apple Car has been dissolved, and without rapid reworking, the car will not make its expected 2025 launch. He has further added that there is currently no project team in place at Apple. (Laoyaoba, Auto Evolution, Mac Rumors, Twitter, 9to5Mac, Apple Insider)

Miso Robotics has announced that it has teamed with fast casual Mexican restaurant chain Chipotle to develop a system designed to deep fry and season chips. The new robot / AI system is currently being tested at the chain’s Cultivate Center food laboratory in Orange County. It expects to start testing Southern California restaurants at some point later this year. Like the Flippy roll out before it, the Chippy’s maker will be using the testing period to determine what works for employees and customers alike. (CN Beta, CNBC, Restaurant Dive, TechCrunch)

SoftBank Group-backed food service robot startup Bear Robotics has raised USD81M in a Series B funding round with investors that include Cleveland Avenue, a venture capital firm founded by a former McDonalds chief executive. Bear Robotics has engineered solutions such as the company’s flagship product named Servi, an all-in-one, fully autonomous mobile robotics answer to daily repetitive work encountered by hospitality employees. (CN Beta, TechCrunch, Reuters, Business Wire)

Amazon’s purchase of MGM Studios for USD8.45B is complete. It is Amazon’s boldest step into the entertainment industry yet, and a manifestation of Amazon’s streaming ambitions. The deal is also the second-largest acquisition in Amazon’s history, after the USD13.7B acquisition of Whole Foods in 2017.(CN Beta, Amazon, The Verge, CNBC)