5-25 #LateFather : TSMC plans to build 9 new factories; Apple plans to release smart glasses at the end of 2026; Apple is reportedly set to partner with Alibaba and Baidu for Apple Intelligence in China; etc.

Qualcomm has announced its Snapdragon 7 Gen 4 (SM7750-AB) chipset as a direct successor to the Snapdragon 7 Gen 3 from 2023. Snapdragon 7 Gen 4 features an updated Kryo CPU with a 1+4+3 configuration. There’s a prime core clocked at 2.8GHz, alongside 4x performance cores at 2.4GHz and 3x efficiency cores at 1.8GHz. Qualcomm claims 27% faster CPU performance over the SD 7 Gen 3. The Adreno GPU gets a 30% boost compared to the previous gen chip. Qualcomm is also bringing select Snapdragon Elite Gaming features, including its Adaptive Performance Engine 4.0. The GPU also supports the HDR10, HDR10+, HDR Vivid and HLG codecs. (CN Beta, GSM Arena, Qualcomm)

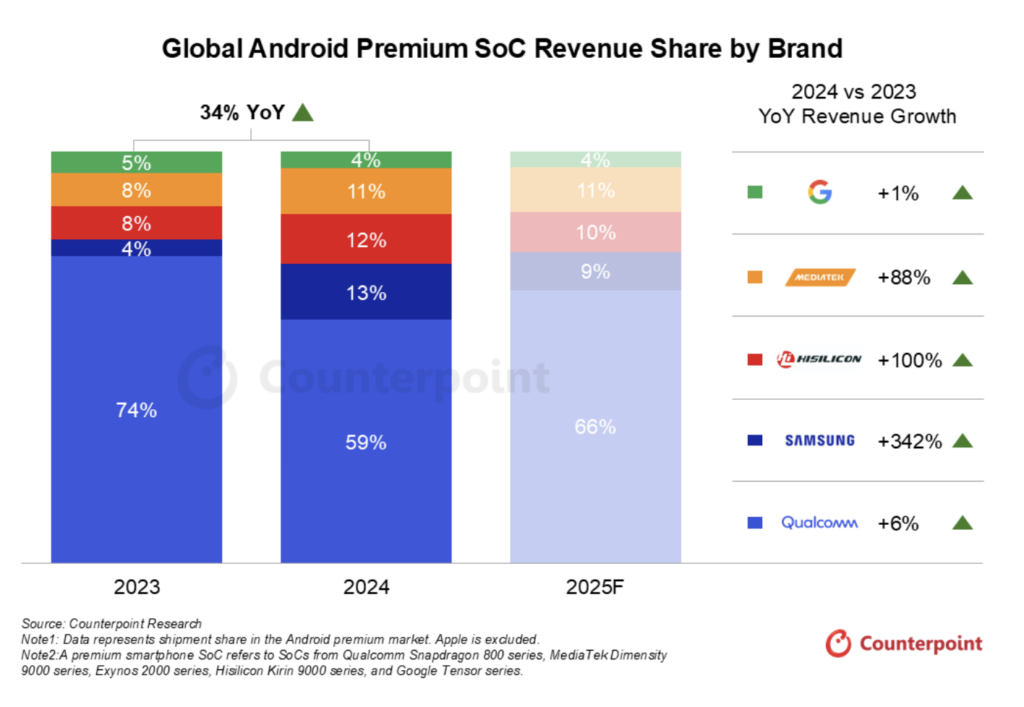

According to Counterpoint Research, Android premium smartphone SoC revenues grew 34% YoY in 2024, driven by increasing demand for premium smartphones and introduction of more powerful AI-capable platforms. Qualcomm remains the market leader growing 6% annually. Although, the vendor lost share in Samsung Galaxy S24 series to Samsung’s Exynos, it will regain share in 2025 as the Samsung Galaxy S25 series has exclusively chosen the Snapdragon 8 Elite SoC. Samsung recovered revenues with Exynos design wins in the Galaxy S & A series, growing revenues by 4x annually. However, it will likely dip in 2025 again, highlighting Exynos’ inconsistent performance. HiSilicon saw a strong comeback in China’s premium market, capturing a 12% revenue share in 2024, driven by a loyal customer base and deep integration with the Harmony OS. In 2025, Huawei is expected to retain its position as the third largest brand by revenue share in the Android premium segment. (Counterpoint Research, CN Beta)

SiCarrier, a Chinese semiconductor equipment startup backed by the Shenzhen municipal government, is seeking to raise USD2.8B in its first funding round, targeting a valuation of around USD11B. Founded in 2021 and closely linked to Huawei, the firm has emerged as a key player in China’s national drive for chipmaking self-sufficiency. The deal, expected to conclude within weeks, would see roughly 25% of a SiCarrier subsidiary sold to investors including state-backed enterprises, sovereign funds, and domestic VC and PE firms. (CN Beta, Reuters, Digitimes)

HUMAIN, the new full AI value chain subsidiary of Saudi Arabia’s Public Investment Fund, has announced a landmark strategic partnership with NVIDIA, the world leader in AI computing infrastructure, to drive the next wave of artificial intelligence development. HUMAIN is making a major investment to build AI factories in the Kingdom of Saudi Arabia with a projected capacity of up to 500 megawatts powered by several hundred thousand of NVIDIA’s most advanced GPUs over the next five years. The first phase of deployment will be an 18,000 NVIDIA GB300 Grace Blackwell AI supercomputer with NVIDIA InfiniBand networking. (CN Beta, Nvidia, CRN Asia)

Arm has announced a simpler, more intuitive naming scheme for its compute platforms to help developers and manufacturers better understand which solutions suit their needs. Under the new naming structure, infrastructure-grade server CPU products will be known as Arm Neoverse, the name previously reserved for Arm’s core IP for server CPUs. The PC lineup will adopt the name Arm Niva, while Arm Lumex will convey its focus on mobile performance to smartphones and tablets. Automotive applications, which require both safety certification and high compute capacity, will fall under Arm Zena. Finally, Arm Orbis will cover IoT and embedded devices, offering a tailored edge AI platform for everything from sensors to earbuds.(CN Beta, Techpowerup, ARM, CNX)

TSMC vice president of advanced technology and mask engineering T.S. Chang has revealed that the company built on average 5 factories per year from 2021 to 2025 and 3 from 2017 to 2020. They plan to build 9 new factories, including 8 wafer fabrication plants and one advanced chip packaging factory. TSMC is slated to start construction of a new wafer fab, its most advanced, in Taichung by the end of 2025. Dubbed Fab 25, the facility is to produce next-generation chips beyond 2nm process technology. In Kaohsiung, TSMC plans to build five wafer fabs to produce chips using the 2nm and A16 technology processes — with the latter its first angstrom-level technology — and next-generation advanced technologies. TSMC expects its 2nm technology to enter volume production in 2H25 at 2 new fabs in Hsinchu and Kaohsiung. n Arizona, TSMC is to start construction of a new manufacturing fab in 2025, while in Japan, the chipmaker plans to start building a second fab in Kumamoto Prefecture by the end of 2025.(CN Beta, UDN, UDN, LTN, Yahoo, TrendForce, Taipei Times)

Samsung has reportedly started mass production of next-gen foldables, except for the tri-fold model. Samsung Galaxy Z Flip 7, codenamed “B7” display will measure 161.57 x 69.96mm. It has a 6.85” inner display, up from 6.7” on its predecessor, plus a bigger 4” cover display. Samsung’s triple foldable still has not gone into mass production. Samsung has been making components for it since the end of Mar 2025, but it has not started building actual phones yet. The tri-fold device is internally known as Q7M, but it is expected to adopt the Galaxy G Fold name when it reaches retail. It will only be available in a couple of countries and only 200K units will be built. The Galaxy Z Flip FE is expected to move 900K units and the Galaxy Z Fold7 will aim for 3M. (GSM Arena, Twitter)

Samsung has showcased two new micro-OLED panels that can deliver brighter high-resolution headsets with richer colors and no motion blur that can output 15,000 nits and 20,000 nits. Currently 2.5K micro-OLED displays from Chinese supplier SeeYA Technology are used in the Bigscreen Beyond series, while 4K micro-OLED displays from Sony are used in Apple Vision Pro, and BOE’s 4K micro-OLED displays are used in Play For Dream MR and Shiftall MeganeX superlight. More headsets using a new Sony 4K micro-OLED are set to launch later in 2025, from Samsung, Sony, and Pimax. Back in 2023, Samsung acquired US micro-OLED company eMagin for USD218M, and the new displays the company is showing are likely based on eMagin’s technology. (CN Beta, UploadVR)

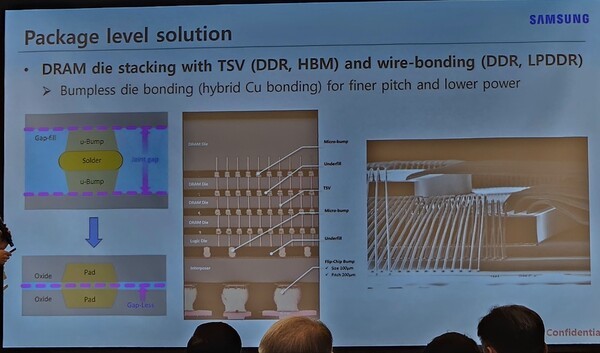

Samsung plans to adopt hybrid bonding technology for its HBM4 to reduce thermals and enable an ultra-wide memory interface. Hybrid bonding is a 3D integration technique that directly connects dies by bonding copper-to-copper and oxide-to-oxide surfaces, eliminating the need for microbumps. Hybrid bonding supports interconnect pitches below 10 µm, offering lower resistance and capacitance, higher density, better thermal performance compared to traditional bump-based stacking, and thinner 3D stacks. Hybrid bonding is a rather expensive technique and while all three leading makers of HBM memory considered it for 12-Hi HBM3E, Micron and Samsung ended up using TC-NCF, while SK hynix uses MR-MUF. Samsung has its own maker of fab tools, Semes, which somewhat reduces its fab costs. However, it is unclear whether Semes can produce advanced hybrid bonding tools for its parent company for now.(CN Beta, Tom’s Hardware, EBN)

Samsung Electronics is doubling down on its leadership in advanced memory technology. Samsung also plans to establish a mass production line for sixth-generation 1c DRAM at its Hwaseong campus. Investments are slated to commence as early as the end of 2025. Samsung initiated 1c DRAM production at its Pyeongtaek Line 4 (P4) facility earlier this year with an initial capacity of approximately 30,000 wafers per month. The strategy has been to focus on initial volumes and then scale investment in tandem with development maturity. Plans are now in motion to boost P4’s capacity by at least 40,000 wafers monthly in 2H25. Simultaneously, Samsung is preparing to convert its Hwaseong Line 17—which currently produces legacy 1z DRAM – toward 1c DRAM manufacturing, potentially launching before year-end. This shift follows previous 1b conversions at Hwaseong’s Lines 15 and 16, indicating a broader roadmap toward modernizing DRAM production assets across the board.(Digitimes, TechNews, TrendForce)

Neuralink has received the U.S. Food and Drug Administration’s “breakthrough” tag for its device to restore communication for individuals with severe speech impairment. The device would help those affected by amyotrophic lateral sclerosis (ALS), stroke, spinal cord injury, cerebral palsy, multiple sclerosis, and other neurological conditions. The health regulator’s breakthrough devices program is intended to provide patients and health care providers with timely access to medical devices by speeding up development, assessment, and review.(CN Beta, Reuters, Yahoo)

Kantar has launched the 20th edition of Kantar BrandZ’s Most Valuable Global Brands report, the world’s most authoritative brand ranking, based on consumer perceptions and financial performance. US brands now comprise 82% of the total value of the Global Top 100, up from 63% in 2006, but a rise among Chinese brands and volatility caused by escalating tariffs could threaten this order. Chinese brands have doubled their value over the past 20 years, now accounting for 6% of the overall value of the Global Top 100. These shifts have come at the expense of European brands, which for now account for only 7% of the Global Top 100 (down from 26% in 2006). (CN Beta, Kantar, Kantar)

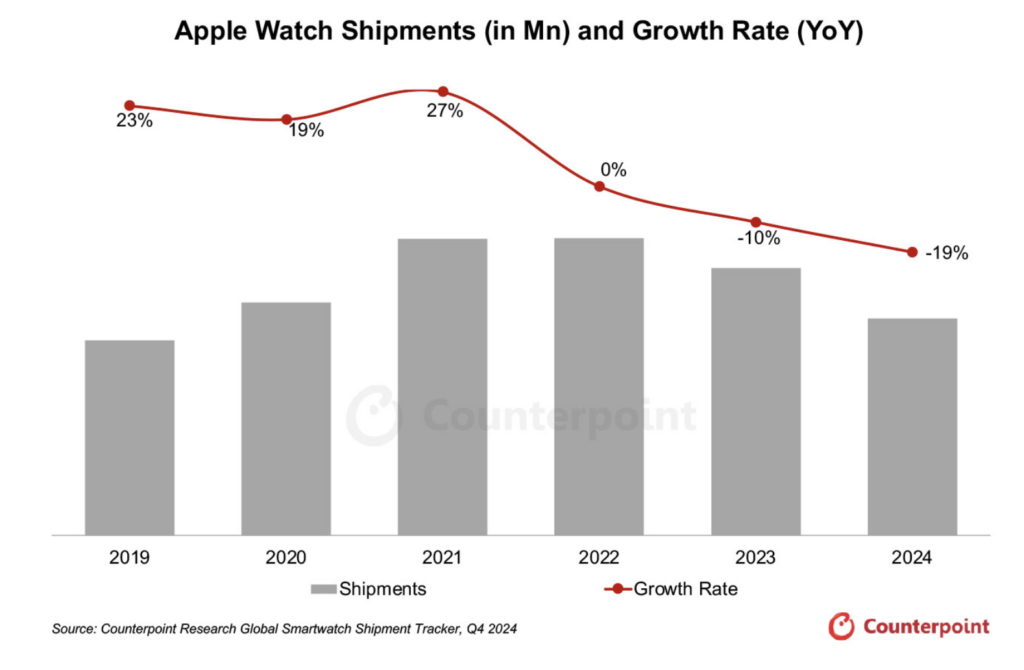

Apple’s smartwatch shipments declined 19% YoY in 2024, according to Counterpoint Research. The brand witnessed declines in all regions except India. However, its global decline was mainly driven by the significant decline in the North American market, which contributes more than half of Apple’s smartwatch shipments. 2024 was the second consecutive year to witness a YoY shipment decline. In the advanced smartwatch segment, Apple’s market share decreased by 8 percentage points YoY in 2024. The 4Q24 was the fifth consecutive quarter to see a decline in Apple’s smartwatch shipments even as all the other major competitors offering advanced smartwatches witnessed growth. (GSM Arena, Counterpoint Research)

According to Mark Gurman at Bloomberg, Apple was developing Apple Watch and Apple Watch Ultra models that had a camera for 2027 to view the wearer’s surrounding environment, but work on those projects ended. The camera in the Apple Watch would not have been used for features like FaceTime or snapping photos, but instead would have allowed Apple Watch owners to get information about objects and places near them. However, Apple is still developing AirPods with tiny cameras inside. The AirPods cameras may be infrared sensors to enable features like enhanced spatial audio, in-air gesture control, and AI capabilities. (Yahoo, Bloomberg, MacRumors, MacRumors)

According to Bloomberg’s Mark Gurman, Apple plans to release smart glasses at the end of 2026, in the Apple’s latest push to diversify its product lineup and boost demand for its artificial intelligence devices. Apple will start producing large quantities of prototypes of the devices at the end of 2025 with overseas suppliers. Apple’s glasses would have cameras, microphones and speakers, allowing them to analyze the external world and take requests via the Siri voice assistant. They could also handle tasks such as phone calls, music playback, live translations and turn-by-turn directions. The approach would be similar to that of Meta’s current glasses and upcoming devices running Alphabet’s Android XR operating system. (Bloomberg, Reuters, Thurott)

According to Mark Gurman and Drake Bennett from Bloomberg, Apple might allow users to pick another voice assistant for their iPhone, including ChatGPT, Amazon Alexa or Google Gemini. The report explains why Apple is still struggling with the broad implementation of artificial intelligence. One reason is Apple’s commitment to user privacy, which is a huge limiter for AI’s ability to collect and utilize user data for LLM training. There is also the interrupted rollout of Apple Intelligence, a feature that took months to reach all iPhone users globally. (GSM Arena, Bloomberg, MacDailyNews)

Samsung is reportedly preparing to include an image-to-video generation feature in its Galaxy AI suite. The Honor 400 series will have the image-to-video feature powered by Google’s AI. It is free for the first 2 months but will require a subscription from then on. (GSM Arena, Twitter)

Google will begin a new fund aimed at investing in artificial intelligence startups. Through a fund it calls the “AI Futures Fund”, eligible startups will get Google investment; early access to AI models; and hands-on support from Google researchers, engineers and go-to-market specialists, the company said in a blog post Monday. They will also get credits to use on Google Cloud. The fund comes as the company tries to get more exposure to the latest AI companies and trends. It also comes as hot AI startups seek alternate funding as the initial public offering market remains mostly dry amid economic woes. (CN Beta, Google, CNBC)

Apple is reportedly set to partner with Alibaba and Baidu for Apple Intelligence, with Alibaba’s models being used for the censorship engine and Baidu’s models used for Siri and Visual Intelligence. In the U.S., Apple has partnered with OpenAI for Siri integration. Apple is likely to launch its Apple Intelligence features in China as part of the upcoming iOS 18.6 release. The company had been aiming to launch its Apple Intelligence in China as part of iOS 18.5, which is set to be released in the middle of 2025. However, several beta versions of the release have not shown any signs of the features, suggesting that iOS 18.6 will be the release that sees Apple Intelligence come to the Asian country. (CN Beta, MSN, Seeking Alpha, Apple Insider, Bloomberg)

Fast-fashion online retailer Shein is leasing a huge warehouse in Vietnam, its first in the country, in a move that could reduce its exposure to unpredictable U.S.-China trade tensions. Shein, which was founded in China and sells products including USD5 bike shorts and USD18 sundresses, has agreed to lease nearly 15 hectares of industrial land for a warehouse near Ho Chi Minh City, Vietnam’s commercial and trading hub. The online retailer, which almost entirely relies on China-based suppliers to make garments for the United States and other markets, has been caught in the crosshairs of a tit-for-tat China-U.S. trade war that threatens to upend global supply chains, despite a recent de-escalation. (CN Beta, Reuters, The Standard)