5-5 #AgingGracefully : Samsung Foundry is allegedly coordinating detailed plans with Qualcomm to produce a 2nm chips; Samsung warned that US tariffs will affect demand for its products; Apple says tariffs had a “limited” impact on Apple’s business; etc.

Samsung Foundry is allegedly coordinating detailed plans with Qualcomm to produce a 2nm mobile application processor (AP). The product under discussion is Qualcomm’s Snapdragon 8 Elite 2 Gen2. While TSMC plans to manufacture it on its 3nm process starting in 2H25, Samsung will use its more advanced 2nm node. The completed chips are expected to be integrated into Samsung Galaxy smartphones slated for launch in 2H26. Design work is to finish in 2Q25, after which mass-production preparations will begin and wafer runs will start in 1Q26. Samsung will allocate this production to its cutting-edge Hwaseong S3 fab. Output is estimated at roughly 1,000 twelve-inch wafers per month. Given that Samsung’s current 2nm capacity is about 7,000 wafers per month, this project would utilize only around 15 % of its available capacity—suggesting this is a modest order rather than a large-scale win. (Android Headlines, Twitter, SEDaily)

Apple’s C1 modem is launched in 2025 in the iPhone 16e. Apple’s CEO Tim Cook made the following remarks about the C1, “We are super excited to ship the first one and get it out there, and it’s gone well. We love that we can produce better products from a point of view of really focusing on battery life and other things that customers want. And so, we have started on a journey, is the way I would put it”. Apple may have already started work on the C2, which should support mmWave networks and will likely be found in the iPhone 18 series.(CN Beta, WCCFtech, 9to5Mac, Apple)

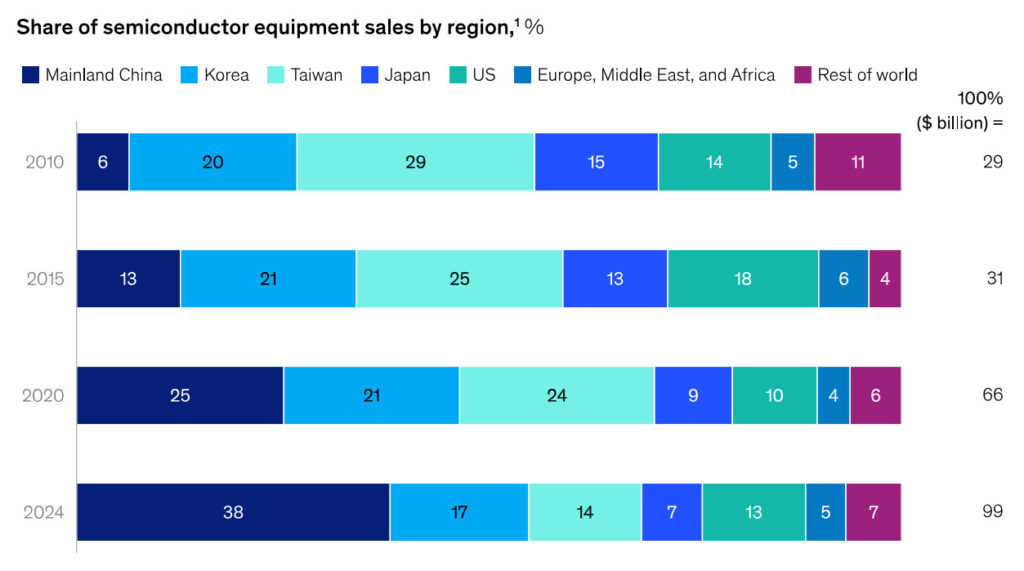

The global semiconductor industry is experiencing notable shifts, largely influenced by the rapid expansion of the Mainland China market. From 2010 to 2024, China’s share of global semiconductor equipment sales rose significantly, from just 6% in 2010 to 38% in 2024. On the other side McKinsey reports that market shares in Taiwan, Korea and Japan are declining. Taiwan has started to build semiconductor fabs in the US and Europe, while Japan has seen few new fab projects despite TSMC’s upcoming Kumamoto plant. At the same time, the US and Europe, the Middle East, and Africa have kept their market shares steady. Globalization helped the semiconductor industry grow from 2010 to 2019, during this time Chinese semiconductor companies expanded, with local firms growing by about 21% each year. But growth slowed from 2019 to 2023 because of US sanctions on Huawei which affected its chip division HiSilicon. Even without HiSilicon, China’s semiconductor industry still grew by 9-10% in that period. (CN Beta, McKinsey, TechPowerup)

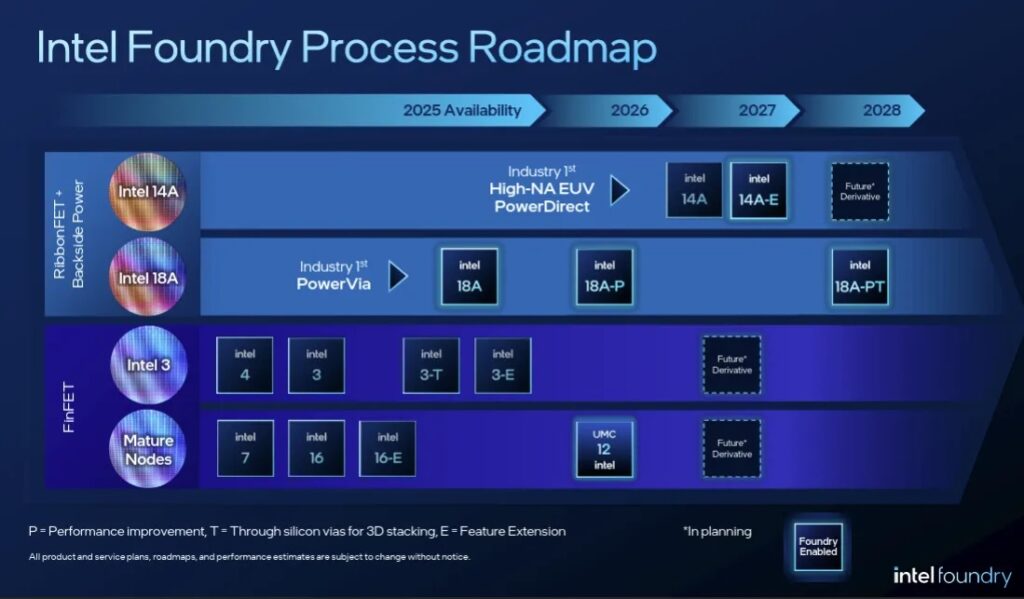

Intel has confirmed that its most advanced node, Intel 18A, is now in risk production, with volume ramp set for 2025. This node will debut PowerVia backside power delivery and RibbonFET transistor architecture. Meanwhile, Intel 14A—its successor—is in early development, with Process Design Kits (PDKs) already distributed to key customers. Intel 14A introduces PowerDirect, a direct-contact power delivery technology that builds on 18A’s foundations. Two derivatives of 18A are also in the works: 18A-P, a performance-enhanced variant compatible with existing 18A design rules. 18A-PT, which adds Foveros Direct hybrid bonding to push interconnect pitches below 5μm, enabling chiplet-based designs with greater integration density. Intel also revealed it has begun trial production of its first 16nm tape-out and is co-developing a 12nm node with UMC, targeted at broader foundry applications. (CN Beta, Tom’s Hardware, TrendForce, Digitimes)

Samsung has outlined several details about its foldable device lineup. Samsung clearly says that in 2025 it will introduce an innovative foldable form factor device. This suggests the Korean firm is indeed planning to launch its tri-fold device later in 2025. A reference to “form factor innovation” would not make sense unless there is something truly new, like a tri-fold device. Samsung’s tri-fold phone will reportedly feature a massive 9.9” display, which will offer users the best viewing experience. Early talk points to it kicking things off with around 200,000 units. (Android Central, Sammy Guru, Seeking Alpha)

Apple may have cancelled the super scratch resistant anti-reflective display coating that it planned to use for the iPhone 17 Pro models. Apple planned to use the anti-reflective coating for the higher-end iPhone 17 Pro and the iPhone 17 Pro Max models, which would have made them the first iPhones with an anti-reflective display. Apple ran into problems scaling up the display coating process, and it is currently no longer a planned feature for the iPhone 17 Pro models. Current iPhone models have a fingerprint-resistant oleophobic coating. If the iPhone 17 models do not end up with the planned anti-reflective display properties, Apple could introduce the display improvement in a future iPhone as the manufacturing process improves.(Android Headlines, MacRumors)

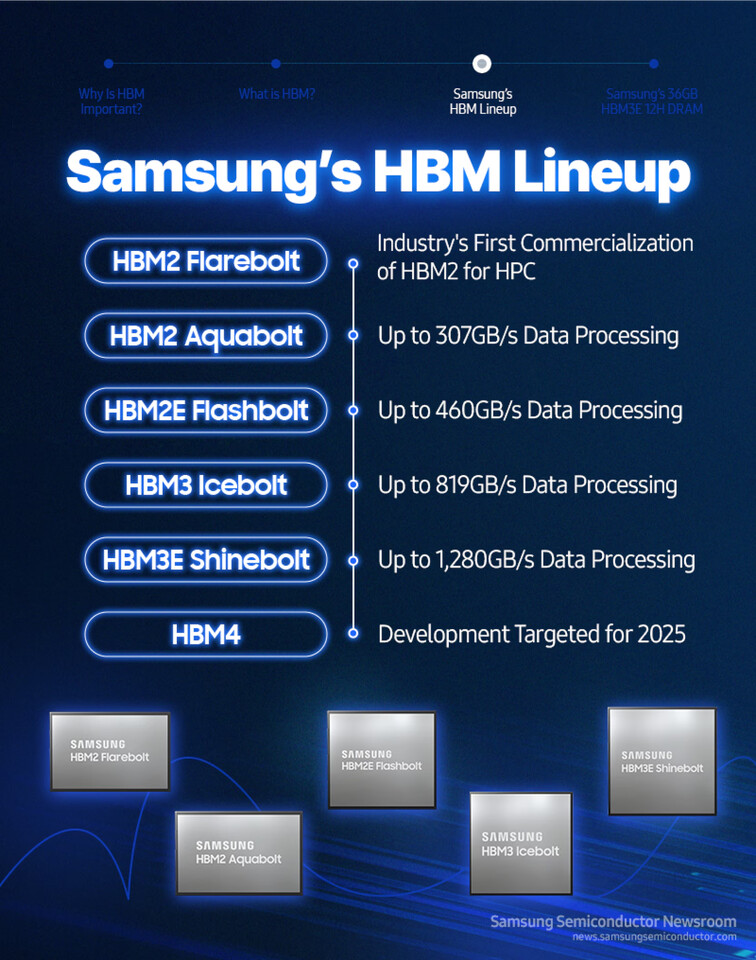

Samsung Electronics is reportedly in talks to supply customized sixth-generation high-bandwidth memory, or HBM4, chips to major AI chipmakers, including Nvidia, Broadcom and Google. Samsung expects to supply HBM4 to its clients as early as 1H26. The move is part of Samsung’s strategic push to seize the lead in the rapidly intensifying AI semiconductor race, outpacing crosstown rival and the world’s top HBM chip supplier SK Hynix. Samsung has officially road-mapped a futuristic “sixth-generation” HBM4 technology, but their immediate focus seems to be a targeted sales expansion of incoming “enhanced HBM3E 12H” products. Previously, Samsung’s Memory Business has lost HBM3 ground—within AI GPU/accelerator market segments—to key competitors. (CN Beta, Samsung, KED Global)

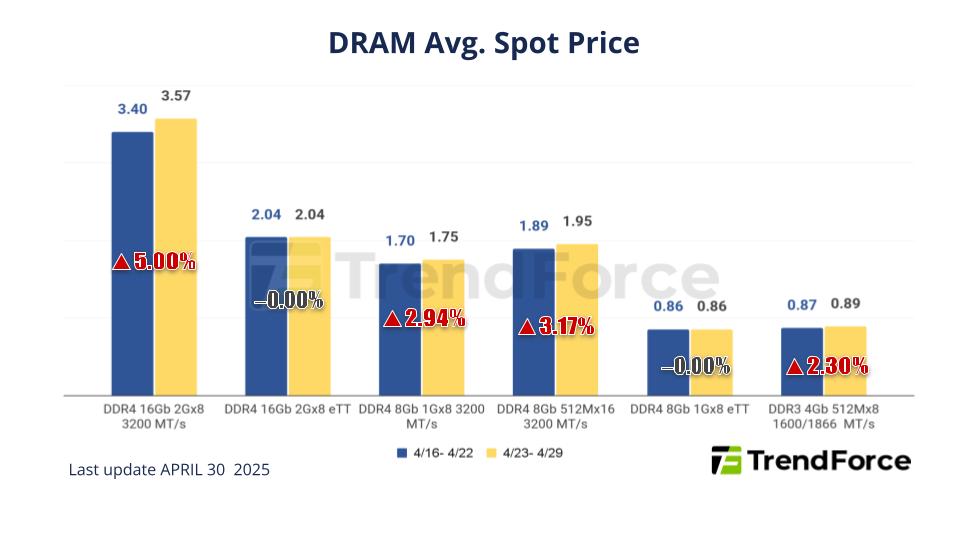

According to TrendForce, regarding DRAM, the three major DRAM suppliers have announced the impending end of production for DDR3 and DDR4 DRAM. This has triggered a rapid response in the spot market, with buyers busily stocking up on related memory products in advance. As for NAND flash, high spot prices and uncertain tariff policies have put the market in a wait-and-see mode. The three major DRAM suppliers have announced the impending end of production for DDR3 and DDR4 DRAM. This has triggered a rapid response in the spot market, with buyers busily stocking up on related memory products in advance. For mainstream chips (i.e., DDR4 1Gx8 3200MT/s), the average spot price has risen by 4.88% from USD1.720 to USD1.804. Price hikes resulted by production cuts are reflected in the spot market ahead of the contract market. The relatively high existing spot prices, together with ambiguity of tariff policies, have shifted the entire market to a wait-and-see status, followed by a sizable reduction in both price inquiries and transactions. Spot prices of 512Gb TLC wafers have dropped by 0.54%, arriving at USD2.749. (CN Beta, TrendForce)

Apple’s two-generations-away iPhone 18 Pro models will likely feature under-display Face ID. The iPhone 18 Pro and iPhone 18 Pro Max will have only a small hole in top-left corner of the screen, to accommodate the front-facing camera, with all Face ID hardware moved under the display. With under-display Face ID, the iPhone 18 Pro models would no longer have a pill-shaped cutout at the top of the screen. However, it is unclear if that means the Dynamic Island feature would be discontinued. (MacRumors, The Information)

Apple must pay a U.S. patent holder USD502M for the use of 4G patents in devices including iPhones and iPads, London’s Court of Appeal ruled, in the latest stage of a long-running legal battle. Texas-based Optis Cellular Technology sued Apple in London in 2019 over its use of patents which Optis says are essential to certain technological standards, such as 4G. London’s High Court ruled in 2023 that Apple should pay Optis a total of USD56.43M plus interest to cover past and future sales over a set period. Optis argued that was far too low and challenged the decision at an appeal heard in Feb and Mar. The Court of Appeal said in a partially-redacted written ruling that Apple should pay a lump sum of USD502M, not including interest, for the period from 2013 to 2027. (Apple Insider, Reuters)

Human Mobile Devices (HMD) and Lava have announced their plans to introduce feature phones with direct-to-mobile (D2M) technology in collaboration with FreeStream, Sinclair, and Tejas Networks. To stream content from platforms like YouTube, Netflix, or other digital services, a device typically needs to be connected to the internet via Wi-Fi or mobile data. With D2M technology, however, the device can directly receive broadcast signals and stream multimedia content without requiring an active internet connection. This will be similar to listening to an FM radio on our phones and cars, where it will deliver both video and audio.(GSM Arena, Indian Express)

Samsung warned that US tariffs will affect demand for its products, including smartphones and chips. A suspension of the “reciprocal tariffs” imposed by US President Donald Trump on countries around the world has seen some customers move up their orders, but Samsung warned this could have a negative effect in 2H25. The steepest tariffs, which have been delayed until Jul 2025 on most countries except China, will also hit countries such as Vietnam and South Korea, where Samsung produces its smartphones, displays and other products. US restrictions on the sale of artificial intelligence (AI) chips to China – a key market for Samsung – are also having an impact.(Android Headlines, Engadget, Financial Times, Yahoo, Twitter)

From the start of 2024 to the present, the Android app marketplace went from hosting about 3.4M apps worldwide to just around 1.8M, according to a new analysis by app intelligence provider Appfigures. That’s a decline of about 47%, representing a significant purge of the apps that have been available to Android users globally. The decline is not part of some larger global trend, the firm also notes. During the same period, Apple’s iOS App Store went from hosting 1.6M apps to now just around 1.64M apps, for instance — a slight increase. In Google’s case, the decline in apps could be a relief for Android device owners who have had to sort through scammy, spammy, and otherwise poor-quality apps to find the best ones to install. The reduction could also help developers who have had to fight for visibility. (Android Authority, TechCrunch)

Apple’s CEO Tim Cook has reportedly identified a crucial factor that could see iPhone manufacturing shift to the United States. U.S. Commerce Secretary Howard Lutnick has shared details of a discussion he had with Apple CEO Tim Cook about the possibility of relocating iPhone production to the U.S. When Lutnick asked the Apple CEO when he expects Apple will make the iPhone on U.S. soil, Cook has allegedly replied that the company needs to have the robotic arms, and do it at a at a scale and a precision that the company could bring manufacturing in U.S. (YouTube, Apple Insider, Yahoo)

Starting in 2026, Apple allegedly plans to change the release cycle for its flagship iPhone lineup. Apple will release the more expensive iPhone 18 Pro models in the fall, delaying the release of the standard iPhone 18 until the spring. The shift may be because Apple plans to debut a foldable iPhone in 2026, which will join the existing iPhone lineup. The fall release will include the iPhone 18 Pro, the iPhone 18 Pro Max, an iPhone 18 Air, and the new foldable iPhone. Later, in spring 2027, Apple will release the standard iPhone 18 and an updated version of the iPhone 16e. Shifting the release schedule will make it easier for Apple to manage an iPhone lineup that has six devices instead of five, a staggered launch would cut down on the number of manufacturing workers that Apple needs to employ at one time. (MacRumors, The Information)

OPPO is reportedly developing a direct competitor to the Apple iPhone 17 Air and Samsung Galaxy S25 Edge. The Samsung Galaxy S25 Edge is allegedly 5.84mm thick, and the Apple iPhone 17 Air is as low as 5.5mm, which is much lower than the 7-10mm thickness of conventional mobile phones. If OPPO launches an ultra-thin flagship model, the thickness is expected to reach about 5mm. (Gizmo China, 163.com)

The average price of Apple iPhone models sold in the U.S. continues to rise as Apple adjusts its lineup, despite more buyers skipping the Pro models. In 1Q25, the U.S. Weighted Average Retail Price (US-WARP) for iPhones rose to USD971, up from USD953 in 4Q24. That USD18 increase reflects shifting dynamics in Apple’s lineup, according to new data from Consumer Intelligence Research Partners (CIRP). Apple launched the iPhone 16e during the quarter, replacing the lower-priced iPhone SE. The iPhone 16e starts at a higher price, lifting the average. At the same time, the company discontinued the iPhone 14 and iPhone 14 Plus, further simplifying the product line. (Apple Insider, CIRP)

Xiaomi, BBK Group (parent company of OPPO, Vivo, and OnePlus), and Huawei are allegedly collaborating to launch a Google-free Android alternative. HyperOS 3 is potentially paving the way for Xiaomi to move incrementally away from Google’s ecosystem, moving forward with a completely independent operating system. For the time being, Xiaomi possesses a license to continue using the Google’s smartphone operating system. (CN Beta, C114, WCCFTech, Xiaomi Time)

Samsung has confirmed that it is considering moving some of its production lines to lessen the financial hit from these tariffs. Many of Samsung’s US-bound phones currently come from Vietnam. Vietnam got hit with a significant 46% tariff rate. Samsung might move production for those specific units over to India, where the tariff rate is considerably lower at 26%. The new tariffs are actually paused for 90 days (though a basic 10% global tariff still applies) to give governments a chance to negotiate trade deals with the US. Samsung’s divisions responsible for TVs, monitors, and home appliances are also looking into relocating some manufacturing to sidestep the tariff impact. They are also focusing on selling more premium products.(Phone Arena, SamMobile)

Apple CEO Tim Cook has elaborated on how tariffs imposed by the U.S. president Donald Trump administration have impacted Apple’s business. According to Tim Cook, tariffs had a “limited” impact on Apple’s business because the company was “able to optimize their supply chain and inventory”. Part of this is due to expanding factories in India and Brazil and flying over 600 tons of iPhones to the United States from India before tariffs take effect. As smartphones and computers are temporarily exempted from paying tariffs and government policies might change at any moment, the impact of tariffs on Apple’s earnings call in Jun 2025 is yet to be discovered. However, the Apple CEO warned that the impact could exceed USD900M with the current tariff rates.(Neowin, MacRumors)

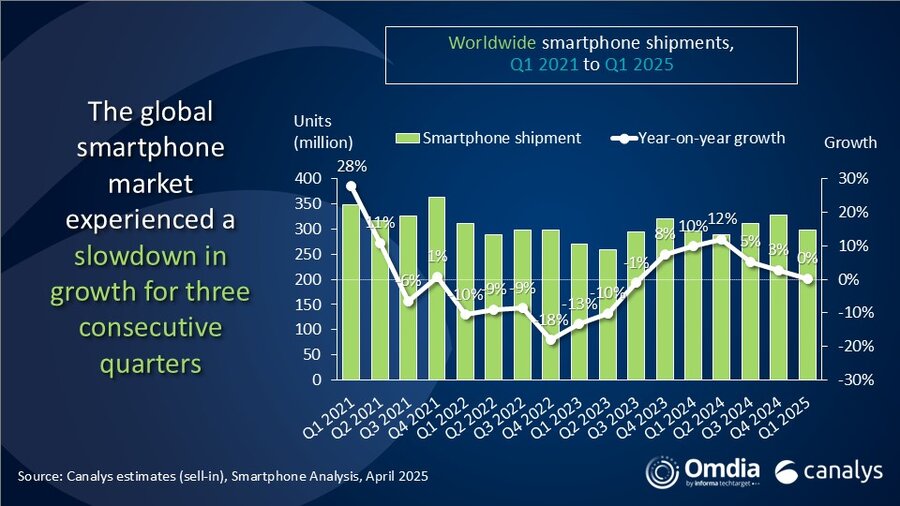

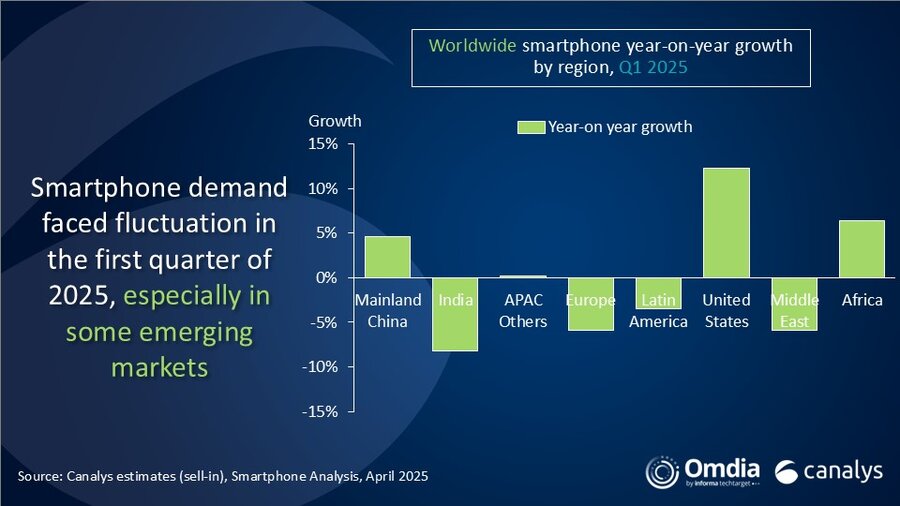

According to the latest Canalys (now part of Omdia) research, in 1Q25, the global smartphone market recorded a slight growth of 0.2%, with shipments reaching 296.9M units. As the peak replacement cycle came to an end and vendors prioritized healthier inventory levels, global smartphone market growth slowed for the third consecutive quarter. Samsung maintained its lead, shipping 60.5M units, supported by the launch of its latest flagship models and competitively priced new A-series products. Apple ranked second with 55.0M units shipped and a 19% market share, driven by growth in emerging Asia Pacific markets and the United States. Xiaomi secured third place with 41.8M units shipped and a 14% market share, leveraging its diverse product ecosystem to strengthen its brand in Mainland China and emerging overseas markets. vivo and OPPO followed in fourth and fifth places, with shipments of 22.9M and 22.7M units, respectively. (CN Beta, Canalys)

Through executive order, U.S. President Donald Trump has ended the so-called de minimis rule, which allowed goods worth USD800 or less to enter the country without tariffs. He is also increasing tariffs on Chinese goods by more than 100%, forcing both Chinese companies like Shein and American giants like Amazon to adjust plans and hike prices. Temu was affected as well, with U.S. shoppers seeing “import charges” 130-150% added to their bills. Now, however, the company is no longer shipping goods directly from China to the United States. Instead, it only displays listings for products available in U.S. warehouses, while goods shipped from China are listed as out of stock. (TechCrunch, CN Beta, CNBC)

Google CEO Sundar Pichai has said that he is hopeful that Gemini will be added as a built-in AI option in Apple iOS in 2025. He added that he has been in talks about the feature with Apple CEO Tim Cook throughout 2024. Pichai hopes that a deal on the matter between the two companies will be done by the middle of 2025. (Bloomberg, GSM Arena)

Samsung has announced that several Samsung Galaxy A smartphones will soon support activating Google’s Gemini assistant by pressing and holding the side button, mirroring the shortcut already available on the flagship Galaxy S series. Samsung confirmed that the update will start rolling out globally in early May 2025. It will enable even more direct Gemini access on the Galaxy A56 5G, A55 5G, A54 5G, A36 5G, A35 5G, A34 5G, A26 5G, A25 5G, A25e 5G, and A24. However, the catch in the footnotes reveals that the phones will only get this update when running on One UI 7.(Gizmo China, Samsung, Android Authority)

Apple is reportedly partnering with Amazon-backed startup Anthropic on a new “vibe-coding” software platform that will use artificial intelligence to write, edit, and test code on behalf of programmers. “Vibe coding” refers to a programming method where AI agents generate code, a concept gaining popularity in the AI landscape. The new AI coding system is an updated version of Apple’s programming software, Xcode, and will integrate Anthropic’s Claude Sonnet AI model. (CN Beta, Bloomberg, TechCrunch, Reuters)

Visa has announced “Intelligent Commerce”, which it says enables AI “to find and buy”. AI agents will be able to shop and make purchases on behalf of consumers, based on preselected preferences. Visa says that it is collaborating with a mix of tech giants and startups to develop AI-powered shopping experiences that are “more personal, more secure, and more convenient”. Those companies include Anthropic, IBM, Microsoft, Mistral AI, OpenAI, Perplexity, Samsung, and Stripe, among others. Mastercard has also announced that it would give AI agents the ability to shop online for consumers. Mastercard said its new Agent Pay offering “will enhance generative AI conversations for people and businesses alike” by integrating payments into tailored recommendations and insights already provided on conversational platforms. Mastercard said it will work with Microsoft on new use cases to scale “agentic commerce”, as well as with IBM, Braintree, and Checkout.com on other aspects of AI-powered shopping. (CN Beta, Visa, TechCrunch, Reuters, Mastercard)

Xiaomi has introduced MiMo, its first open-source large language model designed for reasoning tasks. MiMo uses pretraining and post-training strategies to improve reasoning abilities. Although it has 7B parameters, the model has outperformed larger models in public benchmarks for math reasoning (AIME24-25) and code generation (LiveCodeBench v5), including OpenAI’s o1-mini and Alibaba’s Qwen-32B-Preview. MiMo shows strong performance in mathematical reasoning and code generation. Xiaomi noted that the model is suitable for tasks requiring logical and mathematical inference. Its smaller size may make it practical for enterprise applications or edge computing environments with limited hardware. (CN Beta, TechInAsia, TechNews, Xiaomi)