4-19 #FxxKLife : TSMC has reportedly raised its U.S.-based foundries’ quotations by 30%; Samsung is allegedly increasing costs of DRAM and NAND flash by 3-5%; Google and Samsung are reportedly teaming up on a new pair of XR smart glasses; etc.

Google has outlined 3 benefits that quantum computing will unlock in the coming decades. The first benefit that Google says quantum computers are expected to deliver is drug discovery, leading to better health outcomes. With the technology, researchers will be able to test different drug candidates with their targets and other biological molecules, helping to create more effective medicines. Another benefit is through the development of improved batteries. To improve batteries, Google envisions quantum computers assisting in the design of new materials. It has already worked with the chemical company BASF to determine that quantum computers will be able to simulate Lithium Nickel Oxide (LNO) which could improve industrial production processes and lead to better batteries. Google also said quantum computers will benefit is energy production. Google has collaborated with Sandia National Laboratories to show that quantum algorithms that run on fault-tolerant quantum computers, could “more efficiently simulate the mechanisms needed for sustained fusion reactions”. (Neowin, Google, PNAS)

IBM has announced the z17, a new mainframe to address growing AI demands on enterprise infrastructure. Positioned as a foundation for hybrid cloud environments, and with support for real-time AI and enterprise-grade resilience, the IBM z17 is designed to handle transaction-heavy workloads, improve operational efficiency, and address security concerns in industries with stringent compliance needs. Central to the new mainframe is the Telum II processor. Developed using Samsung 5nm technology, it integrates an on-chip AI coprocessor to support inferencing tasks, including small language models with fewer than 8B parameters.(CN Beta, Sina, IBM, TechRadar)

As the possibility of US tariffs on semiconductor products increases, the South Korean government decided to increase total aid for the semiconductor industry to KRW33T (USD23B), with KRW4T of the amount to be injected directly into relevant companies. The government had previously announced in May 2024 that it would invest KRW26T over 3 years in the semiconductor sector. The new plan expands that commitment to KRW33T, including the 2025 supplementary budget. Under the expanded aid plan, the government will cover KRW1.26T (70% of the company-borne costs) for underground transmission line construction in the Yongin and Pyeongtaek semiconductor clusters, out of a total cost of KRW1.8T. The 2025 supplementary budget will allocate KRW62.6B for the project, with the remainder to be phased in starting in 2026. The government will inject another KRW1.8T into the artificial intelligence (AI) sector, including the acquisition of 10,000 graphics processing units within 2025. (Android Headlines, SamMobile, CNBC, Pulse)

Taiwan Semiconductor Manufacturing Company (TSMC) has reportedly raised its U.S.-based foundries’ quotations by 30%. TSMC is the world’s largest semiconductor manufacturer. Its foundries are home to some of the latest semiconductor production technologies. This explains why big brands such as Apple, Qualcomm, and Nvidia source from TSMC. It is unclear why TSMC is raising its prices. U.S. President Donald Trump’s tariffs will apply to pretty much every country around the world. Trump had also previously suggested that smartphones and computers would be exempt from tariffs but later clarified that they could fall under a general semiconductor tariff plan. This could be one of the reasons why TSMC has raised its prices. (Android Headlines, Phone Arena, Digitimes)

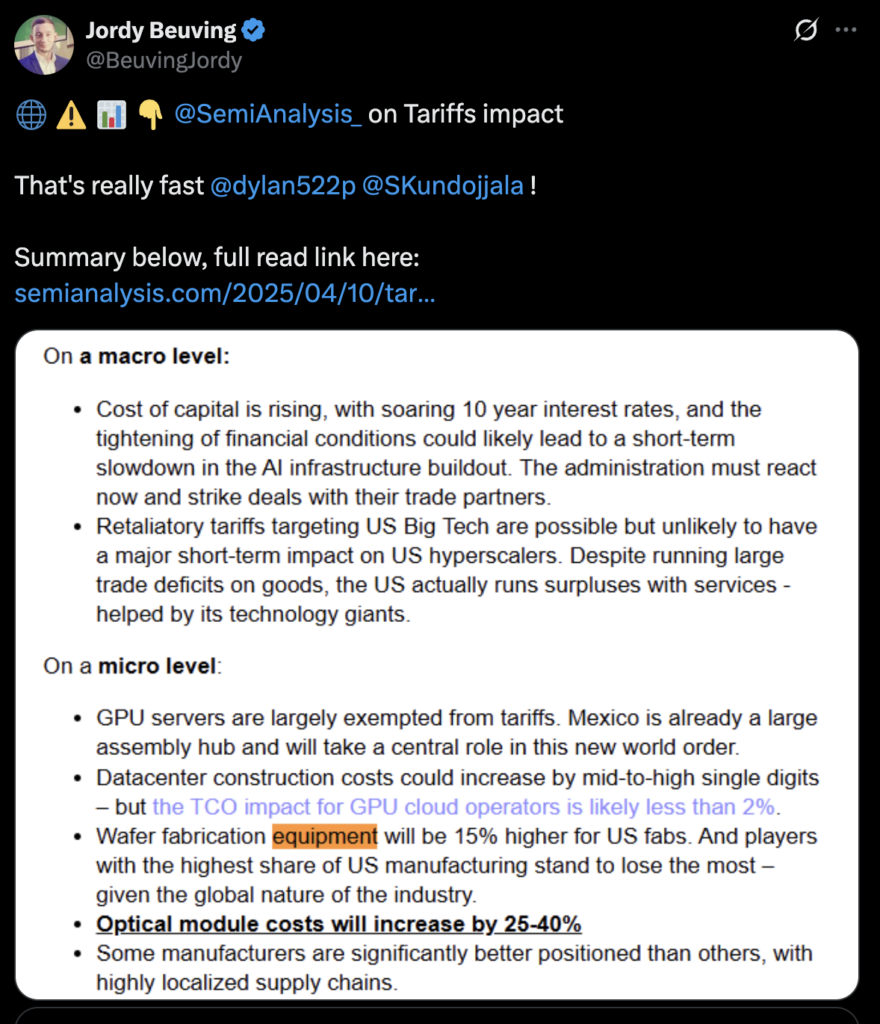

Foundries building new fabs report that the specialized equipment they rely on, everything from extreme ultraviolet (EUV) lithography steppers to chemical vapor deposition chambers, carries a roughly 15% premium compared with similar gear sold overseas. Several forces are at play. The raw materials, high‑grade quartz for vacuum enclosures, and exotic metal alloys for precision optics have climbed in price. At the same time, key components like ultra‑accurate motion stages and alignment sensors are in short supply, sometimes stretching lead times for critical subsystems well beyond 18 months. For a fab racing to move from a 7nm to a 5nm process, those delays can mean missing tight ramp‑up targets and pushing out product launches. Smaller chipmakers feel the squeeze the hardest. With fewer orders to negotiate volume discounts, second‑tier foundries may see their capital budgets balloon by 20% or more. In response, some are taking a mixed approach, sourcing commoditized tools such as oxidation furnaces and rapid thermal processors from multiple suppliers while reserving single‑vendor deals for high‑stakes systems like EUV scanners. (CN Beta, Techpowerup, SemiAnalysis, report)

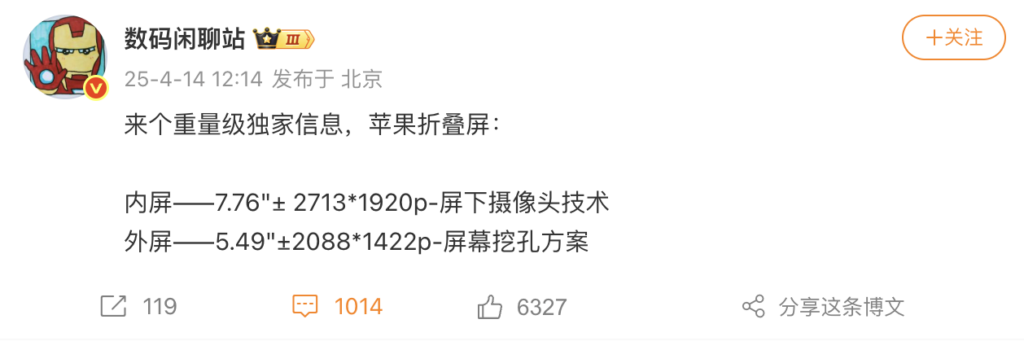

Apple’s upcoming foldable iPhone inner display is approximately 7.76”, will use a 2,713 x 1,920 resolution and feature “under-display camera technology”. Meanwhile, the 5.49” outer display will use 2,088 x 1,422 resolution, and this display will allegedly have a punch-hole camera. The inner folding display will have a 4:3 aspect ratio. Apple is also working on a foldable iPad, and this device will use under-display Face ID technology. (MacRumors, Weibo)

Apple has decided to equip its first foldable iPhone, set for release in 2H26, exclusively with OLED panels from Samsung Display. This decision marks a pivotal moment in the industry as Samsung Display will be the sole supplier, excluding LG Display and BOE panels. Samsung plans to begin full-scale supply by the end of 2025 or early 2026. The foldable iPhone is expected to feature a premium OLED panel similar to the 7.8” iPad Mini tablet PC, with an external display anticipated to be a 5.5” OLED. Priced around USD2,000, it will compete directly with Samsung’s Galaxy Z Fold. This strategic partnership is expected to significantly impact Samsung’s market share in foldable OLEDs, which fell to around 40% in 2024 due to competition from aggressive Chinese companies like BOE. With deliveries commencing soon, Samsung’s market share is predicted to rise dramatically to the 70% range in 2026. Apple will reportedly target 9M or more a year, though it could be as high as 15M units a year. (GSM Arena, Business Korea)

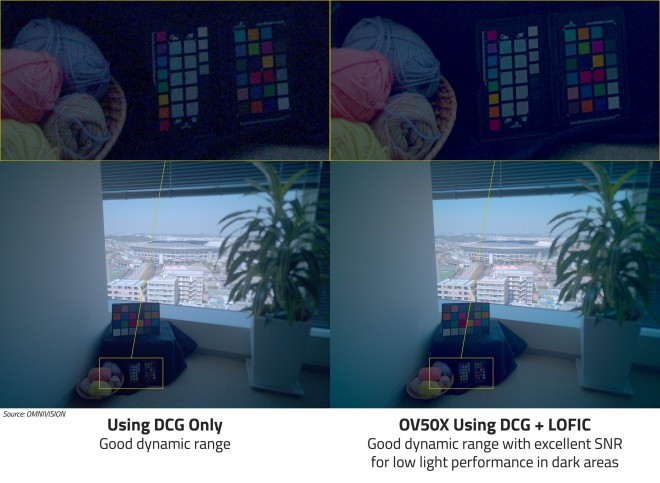

Omnivision released the OV50X, a 50Mp CMOS image sensor targeting flagship smartphones. The sensor boasts a 1.6-micron pixel size within a 1-inch optical format, achieving approximately 110 dB single-exposure HDR, the highest in the mobile sector. The OV50X sensor is optimized for high-end devices, and facilitates 4-cell binning, producing 12.5Mp output at 180 fps, and 60 fps with three-channel HDR. 8K video capture, dual analog gain (DAG) HDR, and on-sensor crop zoom are supported. Its TheiaCel technology enables high dynamic range without multi-exposure, enhancing real-time preview and video quality. 100% quad phase detection (QPD) coverage ensures rapid, precise autofocus. PureCel Plus‑S stacked-die technology improves low-light performance. (Gizmo China, GSM Arena, Omnivision)

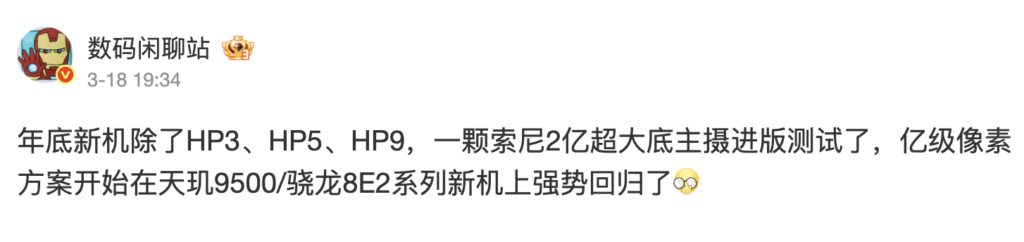

Sony is allegedly working on 200Mp and 100Mp camera image sensors. The 100Mp sensor will be adopted by many Chinese OEMS for their Qualcomm Snapdragon 8 Elite 2 or MediaTek Dimensity 9500-powered flagship smartphones. As for the 200Mp sensor, Sony is expected to use it in one of its upcoming smartphones and is also expected to sell it to other Chinese OEMs. (Gizmo China, Weibo)

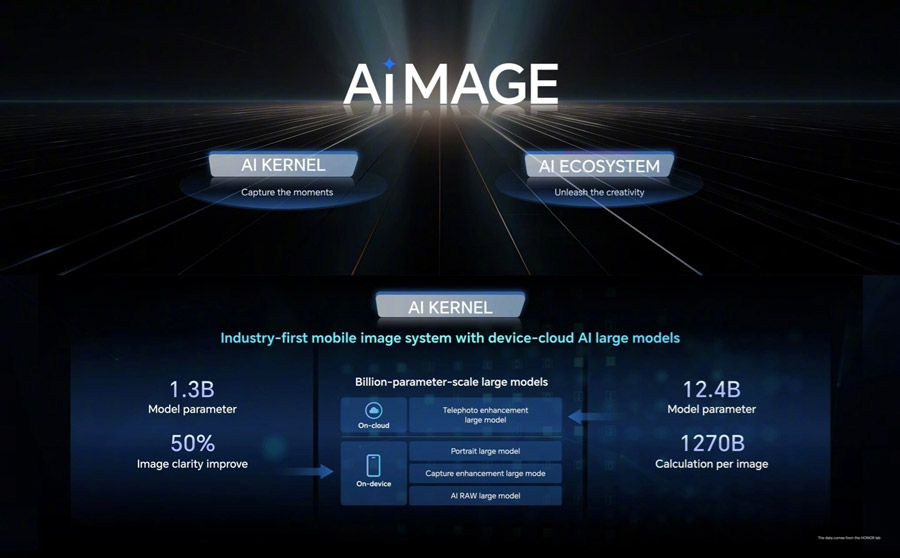

Honor has revealed a set of tools that will be available to end users: the AiMAGE suite. One of the features is AI Outpainting that will help users automatically reframe a photo to obtain the best possible result. It will zoom and rotate until the ideal framing is found. The resulting blank areas will be automatically filled thanks to Google’s Imagen Model. Another feature AI Eraser will allow users to remove unwanted elements from an image in just a few taps. Google’s Imagen model will assist by automatically filling in the blanks with a contextually appropriate result. AI Upscale is a feature specifically designed to restore old portraits. It allows to breathe new life into precious old family photos. (Android Headlines, Honor, GSM Arena, MDroid)

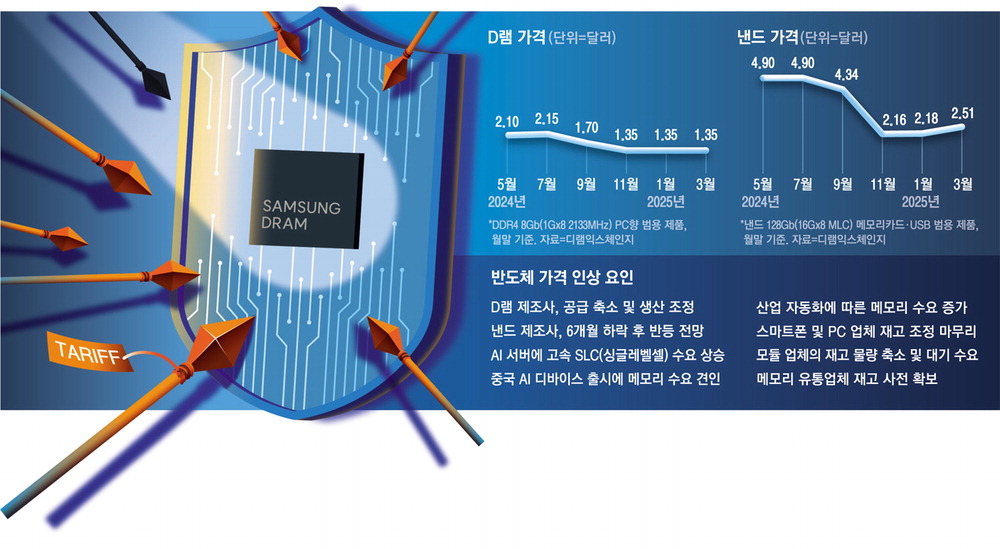

Samsung Electronics is allegedly coordinating with major customers a plan to increase costs of DRAM and NAND flash by 3-5%. Samsung Electronics has used a strategy that prioritizes maintaining market share over price hikes even in the midst of a freeze in the memory market. This is because there was not much room to raise prices amid the double pressure of weak demand and oversupply. Recently, however, there have been signs of change in the market. Major memory manufacturers have maintained their production cuts since last year to improve profitability. In addition, Samsung Electronics, SK Hynix, and Micron are all adjusting their portfolios around high value-added products. Based on the data from DRAMeXchange, DDR5 memory module pricing has risen by up to 12%, and the demand was mainly from HPC servers, while NAND pricing saw a 9% rise. (MK, Business Korea, Sohu, WCCFTech)

SK Hynix has completed the full acquisition of Intel’s NAND Flash division, concluding a 4-year process. The assets will be integrated under Solidigm, SK Hynix’s US subsidiary, to enhance R&D collaboration for enterprise-grade SSDs. The acquisition was valued at approximately USD8.85B. SK Hynix aims to develop new operational strategies and expand its enterprise SSD business, reinforcing its position in the NAND market. SK Hynix first sought to strengthen its NAND competitiveness by signing a business transfer agreement with Intel in Oct 2020. The acquisition proceeded in 2 phases. In 2021, SK Hynix paid USD6.61B to acquire Intel’s Dalian, China production facilities and SSD division via Solidigm. However, Intel retained ownership of IP, R&D, and key personnel until the final stage. In 2025, SK Hynix paid the final USD2.24B payment, securing full ownership of the assets. (Business Journal, Tom’s Hardware, Techpowerup, Digitimes, Chosun)

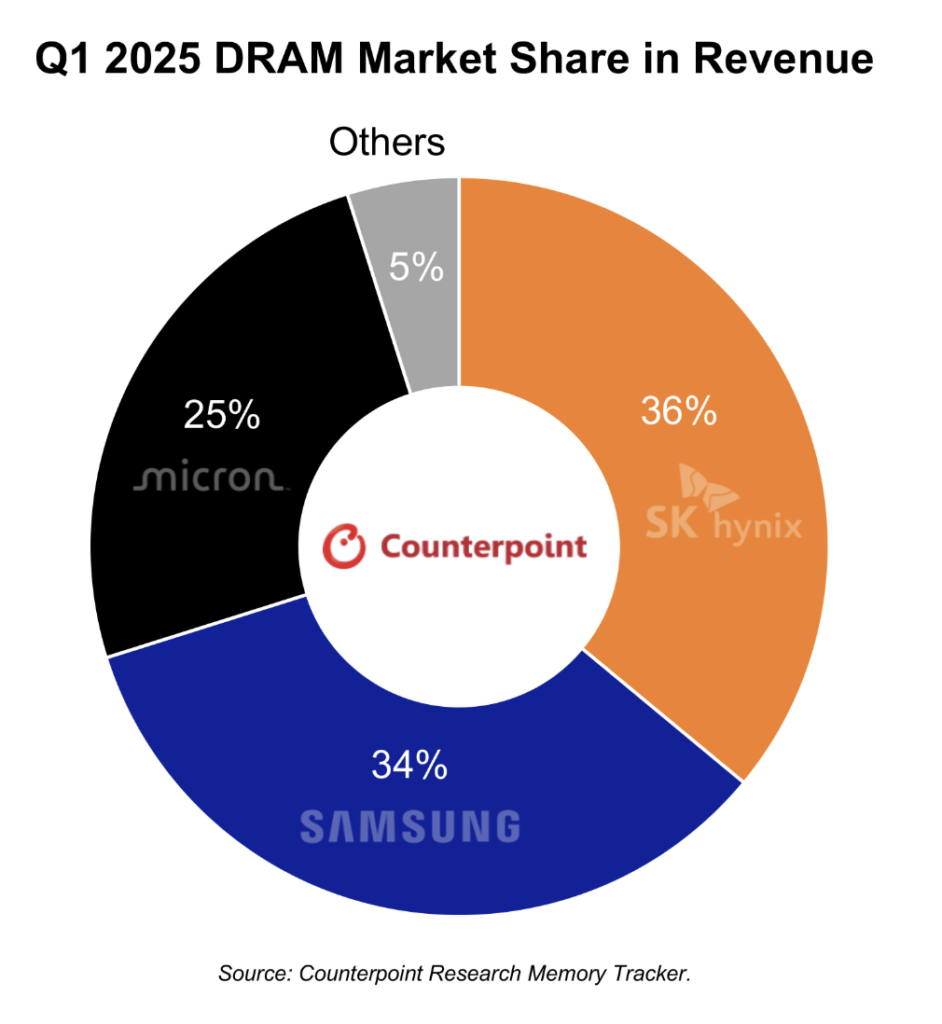

According to Counterpoint Research, Samsung’s market share in the global DRAM market was approximately 34% for 1Q25, while SK Hynix held about 36%, resulting in Samsung losing its title as the leading DRAM provider. Micron ranked third with a market share of around 25%. Starting Mar 2024, SK Hynix began supplying Nvidia with its fifth-generation HBM3E, while Samsung had not yet delivered any positive news regarding shipments until recently. Counterpoint Research further predicts that the ranking for DRAM market shares in 2Q25 is likely to resemble that of 1Q25. (Digitimes, Counterpoint Research)

Infinix is preparing to introduce a new smartphone in India that comes with a unique scent-tech, a built-in mechanism that allows the device to release a light fragrance from its rear panel. The technology will make its debut with the upcoming Infinix Note 50s 5G+. According to Infinix India CEO Anish Kapoor, it uses microencapsulation technology which traps fragrance molecules within microscopic capsules. The capsules are infused into the phone’s fake leather back, and they gradually release a light, refreshing scent over time. The scent is going to be subtle and should last around six months, though its intensity and duration will vary based on how the phone is used and the ambient conditions like temperature and humidity.(CN Beta, GSM Arena, Digit)

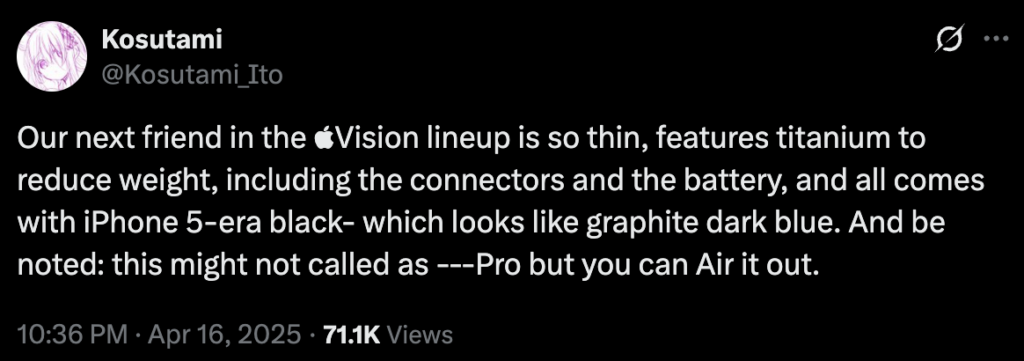

Apple allegedly plans to incorporate titanium into the Vision Pro 2’s construction to cut down on weight. Apple will not use titanium for the whole chassis but mostly for the internal construction. The outside of the headset will still be aluminium, painted in black, which looks a lot like “dark graphite blue”. Moreover, Apple’s next AR headset will likely not be called “Vision Pro 2” but “Vision” or “Vision Air”, reflecting its new lightweight design. (GSM Arena, Twitter)

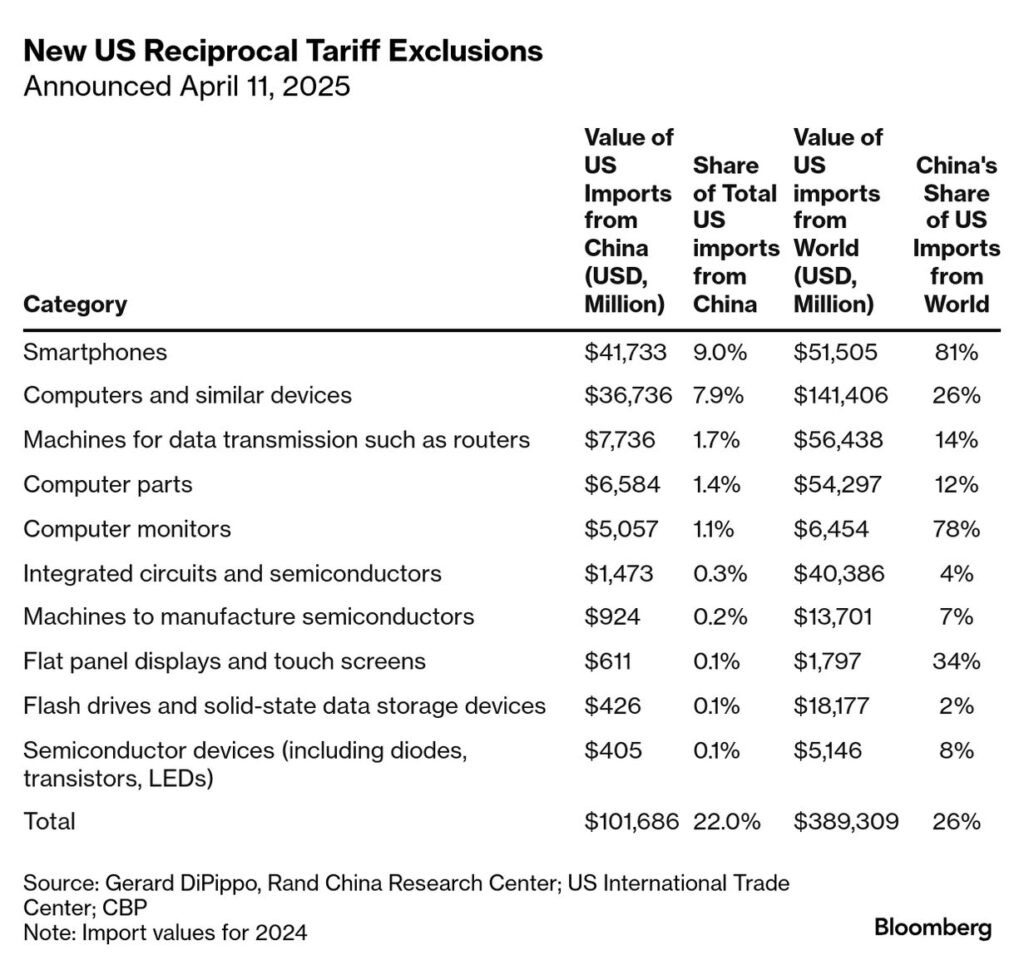

According to new guidance from the U.S. Customs and Border Protection, smartphones and other electronic components will be exempt from U.S. President Donald Trump’s tariffs. The US Customs and Border Patrol (CBP) issued a list of 20 product codes that would be exempt from these “reciprocal” tariffs. Exempted products include smartphones, computers, laptops, displays and projectors (including touchscreens), semiconductors and integrated circuits, LEDs, and solid-state storage. According to President Donald Trump, devices, including smartphones, computers, and others, are just moving to “a different tariff bucket”, wherein the administration will consider levying tariffs on “Semiconductors and the whole electronics supply chain”. Expect to hear more on these new tariffs in the coming weeks. (Bloomberg, Android Authority, Truth Social, Android Headlines, Android Central, US Customs and Border Patrol)

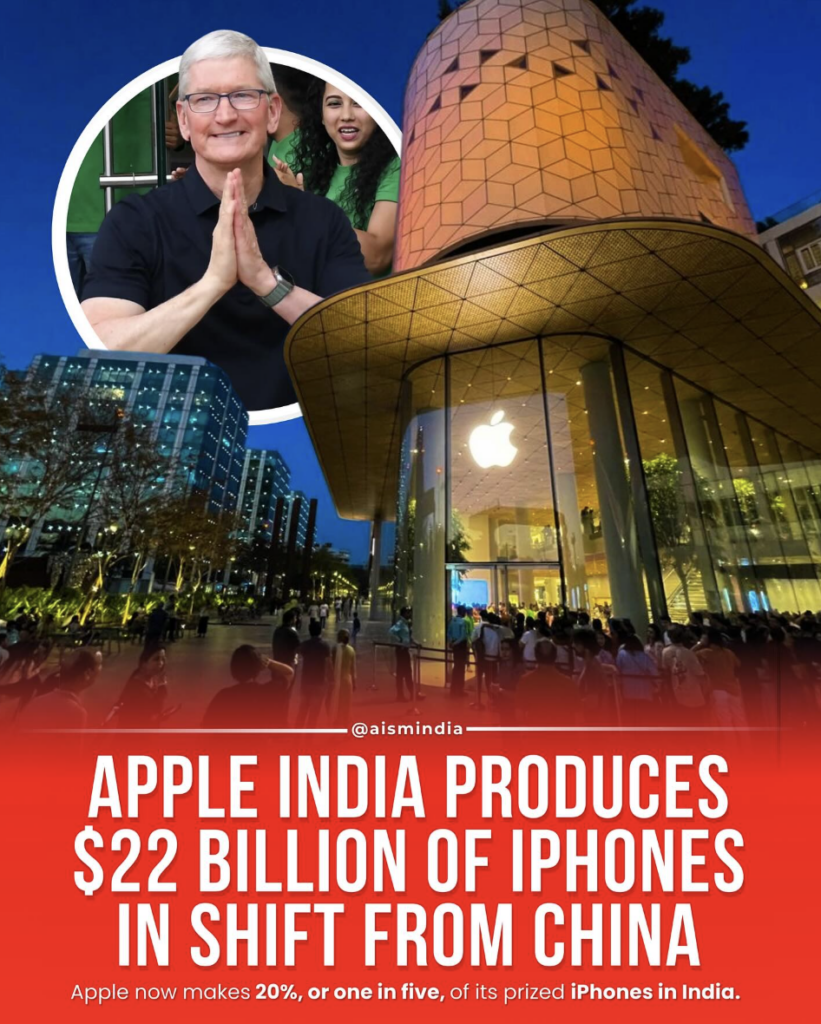

Apple has assembled USD22B worth of iPhones in India in the 12 months ended Mar 2025, increasing production by nearly 60% over the previous year in a sign of continued diversification away from China. Apple now makes 20% of its iPhones in India. Of the total India production, Apple exported INR1.5T worth of iPhones from the region in the fiscal year through Mar 2025, according to the nation’s Technology Minister. (CN Beta, Bloomberg, MSN, India Times)

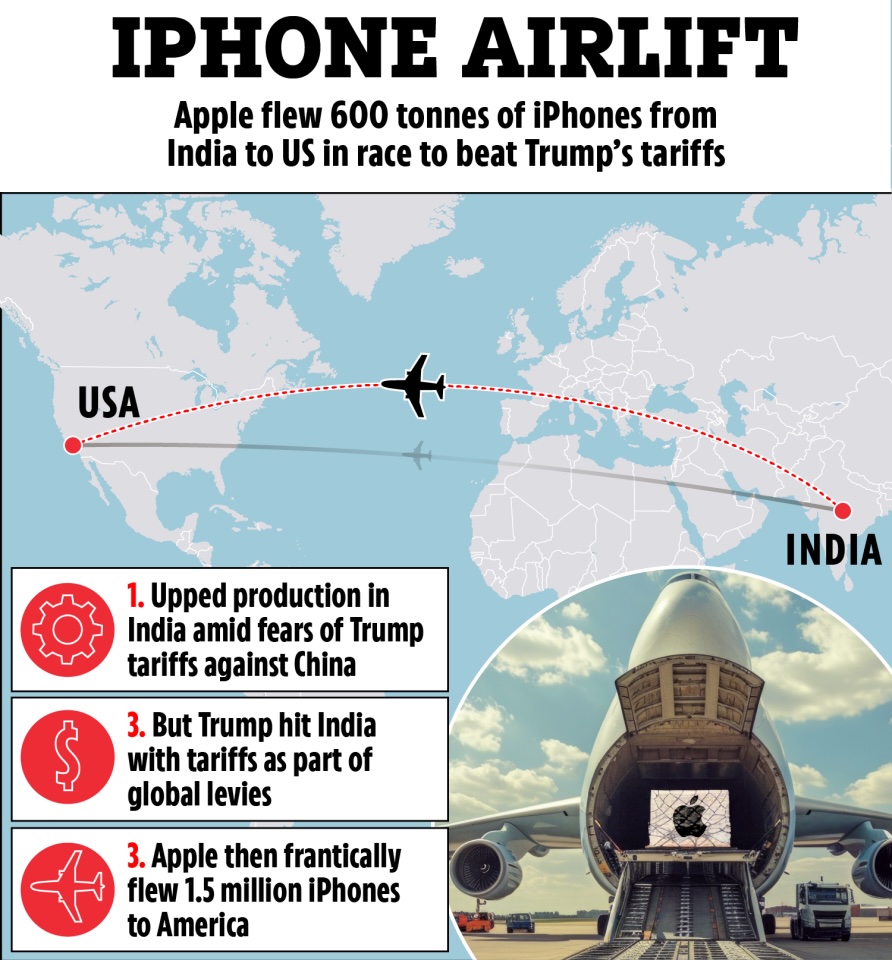

Apple’s main India suppliers Foxconn and Tata shipped nearly USD2B worth of iPhones to the United States in Mar 2025, an all-time high, as the U.S. company airlifted devices to bypass President Donald Trump’s impending tariffs, customs data shows. The smartphone maker stepped up production in India and chartered cargo flights to ferry 600 tons of iPhones to the United States to ensure sufficient inventory in one of its biggest markets on concern Trump’s tariffs would push up costs. In Apr 2025, the U.S. administration imposed 26% duties on imports from India, much lower than the more than 100% China was facing at the time. Trump has since paused most duties, except for China for 3 months. (Android Headlines, Reuters, The Guardian, CNBC, Yahoo)

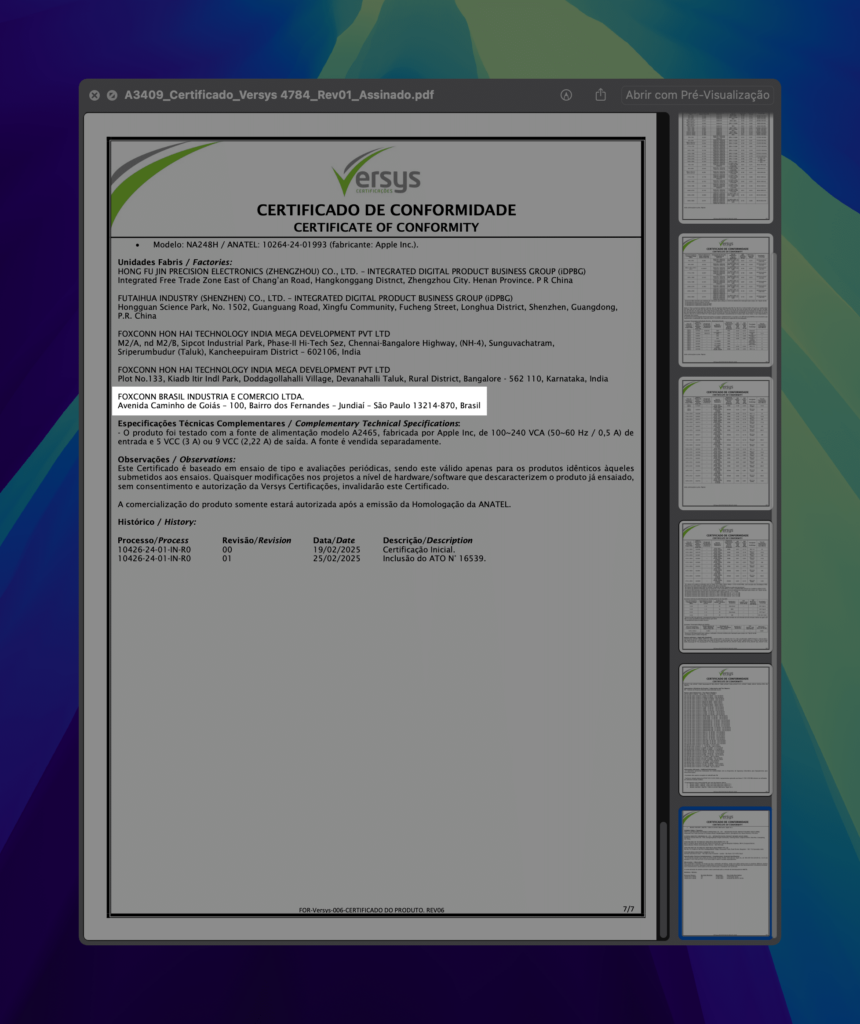

Apple’s supplier Foxconn has been diversifying its iPhone assembly facilities beyond China for years now with plants in India, Vietnam, and Brazil. Apple iPhone 16e units sold in Brazil are manufactured locally at the Foxconn factory in Jundiaí, São Paulo. The retail boxes of the iPhone 16e sold in Brazil feature an “Assembled in Brazil – Brazilian Industry” tag. The devices come with the A3409 model number and MD1R4BR/A identifier. Foxconn has been assembling the iPhone SE 2020, as well as the vanilla iPhone 13, 14, 15, and 16 models. (GSM Arena, MacMagazine)

Apple is working on a new version of the Vision Pro with two key advantages over the current model, according to Bloomberg’s Mark Gurman. Apple is developing a new headset that is both lighter and less expensive than the current Vision Pro, which starts at USD3,499 in the U.S. and weighs up to 1.5 pounds. Gurman said Apple is also working on another version of the Vision Pro that can have a wired connection with a Mac, for an ultra-low-latency experience. (Bloomberg, UploadVR, MacRumors)

According to Bloomberg’s Mark Gurman, Apple’s CEO Tim Cook is still very much interested in producing Apple Glass. Cook is doing what he can to get the smart glasses made. Cook wants true augmented reality glasses — lightweight spectacles that a customer could wear all day. The AR element will overlay data and images onto real-world views. It has become a top priority for Apple’s engineers, all to try and outpace Meta in creating a category-leading device. (Apple Insider, Forbes, Bloomberg, Money Control)

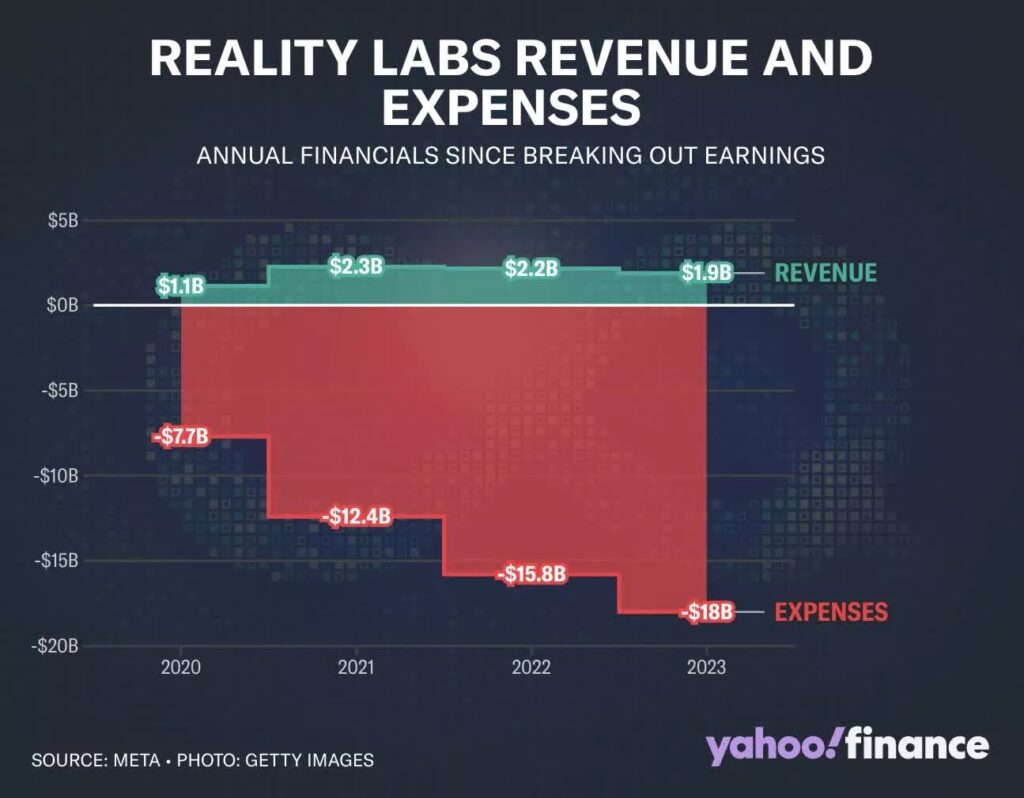

In just over 4 years, Meta’s Reality Labs division, which has focused mainly on its products in augmented reality (AR), virtual reality (VR), and the metaverse, has lost as much money as the market caps of Snap and Pinterest combined. Meta’s metaverse project has consumed USD45B by early 2025. Financial disclosures show the branch’s losses have surged over the last several years – more than USD6B in 2020, USD10B in 2021, USD13B in 2022, and USD16B in 2023. The division lost another USD3.8B in just 1Q24, wiping out its total revenue from 2022 and 2023 combined. Despite rising expenditures, the division’s annual revenue has declined steadily since 2021 due to weak sales and continued failure to gain mainstream traction.(CN Beta, Techspot, Yahoo)

Google and Samsung are reportedly teaming up on a new pair of XR smart glasses, rumored to launch in 2026, featuring built-in translation, object recognition, and memory-assisted search. The glasses may blend Meta Ray-Ban-style features with a built-in display and may run Android XR, the platform co-developed by both companies.(Android Headlines, TechRadar, Axios, KED Global)

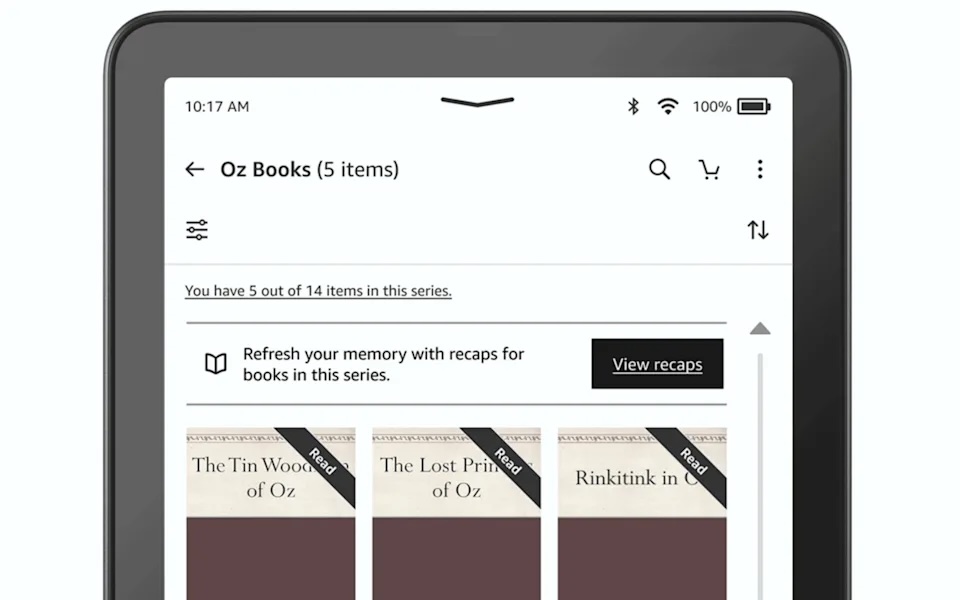

Amazon is introducing a new “Recaps” feature for Kindle users to help them recall plot points and character arcs before picking up the latest book in a series. Amazon has confirmed that recaps are AI-generated. Kindle device users in the United States can now view short recaps for books they’ve either purchased or borrowed for thousands of best-selling English-language e-books in series. Amazon plans to bring the recaps feature to the Kindle app for iOS soon. To access recaps, users need to be on the latest Kindle software. Users can check if a series has a recap by looking for the “View Recaps” button on the series page in their Kindle Library or through the “View Recaps” option within the series grouping three-dot menu. (Engadget, TechCrunch, Amazon)

Netflix has rolled out access to a new AI search engine tool to some of its subscribers. The AI search engine, which is powered by ChatGPT creator OpenAI, takes Netflix’s search capabilities beyond looking up movies and TV shows by title, genre, or actor. The tool allows users to search for content using numerous other search queries, such as mood. Being that the feature is powered by OpenAI, it appears likely that users will be able to use natural language in their search. The AI search engine is currently in the testing phase. It’s currently only available on iOS devices and to some customers in Australia and New Zealand. In addition, those subscribers need to specifically opt-in to use the tool. (Bloomberg, Yahoo, Android Central, Mashable)

Perplexity AI is seeking arrangements with notable OEMs. The company is looking to go toe-to-toe with the likes of Google’s Gemini and OpenAI’s ChatGPT as a potential on-device AI assistant. Perplexity AI has allegedly reached out to Samsung and Motorola about the possibility of being loaded onto phones as a “default” option. Perplexity AI has reportedly agreed upon a deal with Motorola’s parent company, Lenovo, for assistant integration. This agreement will allegedly have Perplexity’s software “pre-loaded” onto Motorola’s phones as a secondary option besides Gemini. Samsung’s talks are still early. This is apparently partly due to Samsung’s close relations with Google and its haul of AI features. However, if things go well, Samsung could feature Perplexity’s AI as an assistant option or pre-load its app for users. (Android Central, Bloomberg, Yahoo)

OpenAI is in talks to pay about USD3B to acquire Windsurf, an artificial intelligence tool for coding help. Windsurf, formerly known as Codeium, competes with Cursor, another popular AI coding tool, as well as existing AI coding features from companies such as Microsoft, Anthropic and OpenAI itself. OpenAI is rushing to stay ahead in the generative AI race, where competitors including Google, Anthropic and Elon Musk’s xAI are investing heavily and regularly rolling out new products. Late in Mar 2025, OpenAI closed a USD40B funding round, the largest on record for a private tech company, at a USD300B valuation. OpenAI has released its latest AI models, o3 and o4-mini, which it said are capable of “thinking with images”, meaning they can understand and analyze a user’s sketches and diagrams, even if they are low quality.(Neowin, Bloomberg, CNBC)